The European session on Friday started with a new wave of euro selling, which was supported by weak preliminary PMIs.

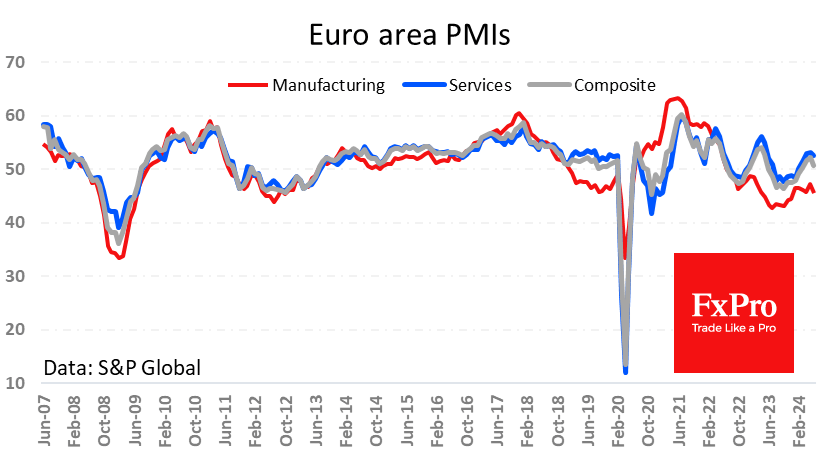

According to June estimates, the strengthening of economic activity in the eurozone, which has been gaining momentum since October, is at risk of reversing. The composite index fell from 52.2 to 50.8, contrasting unpleasantly with the expected rise to 52.5. The services sector slipped for a second month, causing the index to fall from 53.2 to 52.6 instead of the expected rise to 53.5.

The jump in manufacturing activity last month also looks like a positive anomaly, as the index fell to 45.6 from 47.3 a month earlier, close to April’s reading of 45.6.

PMI values below 50 indicate a contraction in activity by last month, and the euro region’s industry has been below this waterline since July 2022. The services sector is more buoyant and only recorded a contraction between August 2023 and February 2024.

The downward trend reversal strengthens the case for monetary easing, and the ECB took the first step on this path earlier in June with a rate cut.

The Eurozone PMI has established itself as a reliable leading indicator of economic activity, and the latest data shows serious risks of a slowdown.

This is bad news for the European currency. EURUSD slipped below 1.0700, almost duplicating last Friday’s lows just below 1.0670.

If comparable data from the U.S. does not present similar unpleasant surprises, EURUSD may approach 1.06 without many obstacles, returning to the lows of April.

A pullback to 1.06 or even 1.05 would test the single currency’s support boundaries. A failure below would signal a fundamental change of attitude towards the euro, which would open the way below parity with a downside potential of 0.85.

This negative scenario is possible if Europe’s current economic cracks cannot be quickly mended by responding positively to monetary easing.

This is a possible scenario given the increased debt burden in the major economies, which reduces the effectiveness and space for stimulus. However, things could still unfold positively for Europe if we see a revival in the wake of the ECB’s key rate cut in June.

The FxPro Analyst Team