The US dollar has been settling near two-month highs since late last week, but this is a pick of the best among the worst. Expectations for the Fed’s key year-end rate have changed little over the past roughly three weeks. Still, the dollar’s main competitors have faced their difficulties one after another, coming under selling pressure.

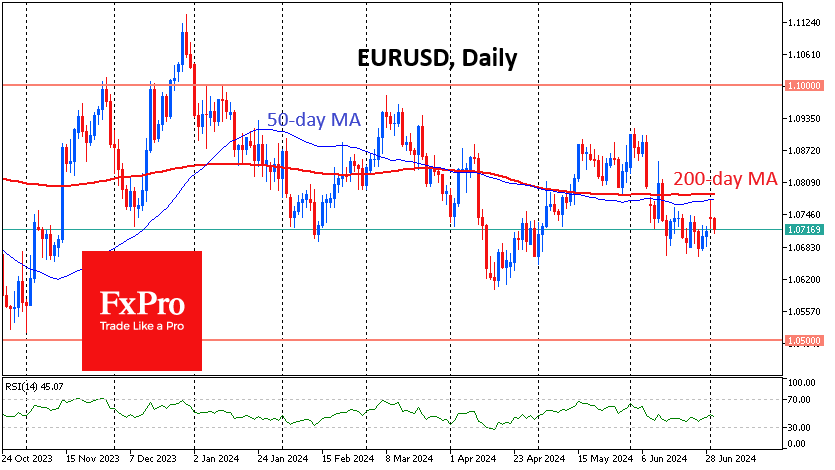

Political uncertainty remains over France and the UK due to expectations of opposition parties coming to power. Some investors fear accelerating de-globalisation, which is seen as negative by global investors. The results of the first round in France spurred the euro only briefly, and by midday on Tuesday, EURUSD again approached 1.0710, where it spent the second half of June. It is worth noting that this euro sell-off is also supported by declines in bonds and the equity market.

The slightly less one-note but highly dramatic story in the yen continues. The USDJPY has been hitting highs since 1986, rising to 161.6. The pair has been selling off since the beginning of the week, touching 161.7, but minor pullbacks do not allow for shock-and-awe interventions that could reverse the momentum. Japan’s stock market is taking advantage of the yen’s weakness, trying to return to levels above 40000 on the Nikkei225, despite the decline in key global benchmarks.

The Swiss franc is giving up ground almost daily following the Swiss Central Bank’s second consecutive policy easing on 20 June, taking USDCHF back above 0.90, a one-month high.

Technically, the DXY Dollar Index continues to hover near the lower boundary of the rising channel. The dollar needs to rise another 0.5% to confirm this upward trend, breaking the area of previous peaks. If the bulls are successful at this stage, the dollar will be able to grow to the upper boundary of the corridor (now at 109), which has the potential to strengthen by about 3% to the current levels.

A more hawkish tone of the central bank officials compared to Europe and more robust economic growth figures will help the USD on this growth path, promising less active easing of monetary policy conditions in the foreseeable future. A continued bullish bias for the dollar threatens to push EURUSD back below 1.05 before the end of summer, where the pair briefly dipped in early October 2023.

The FxPro Analyst Team