Dollar Index: if it doesn’t rise, it falls

March 07, 2024 @ 10:49 +03:00

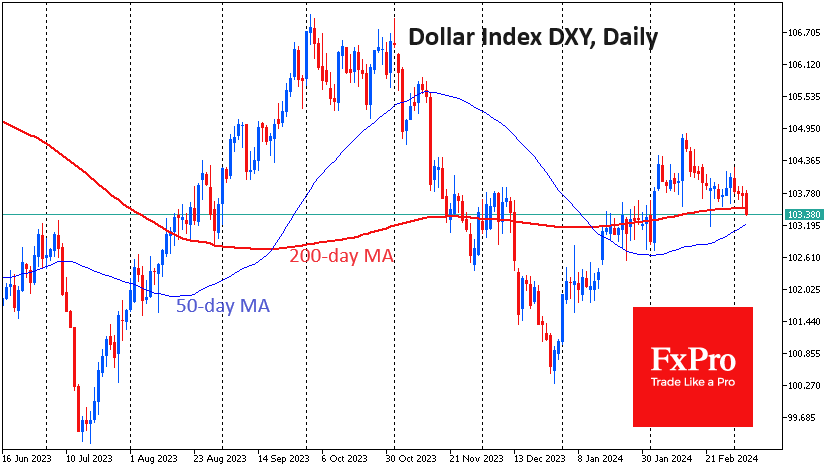

The Dollar Index lost a third of a per cent on Wednesday and is once again attempting to break below its 200-day moving average (MA). Perhaps the formula “if it doesn’t rise, it falls” can be applied to the dollar.

In early February, the dollar managed to consolidate above this line in a sharp move, but this did not put it on a growth path as one would expect. In November and December, signals that the next move would be a rate cut took almost 6% off the dollar. The dollar was only able to recover half of these losses as forecasts for the first cut were pushed back from March to June and from 6 to 3 cuts this year.

The dollar’s modest performance suggests impressive selling pressure despite the positive fundamental backdrop. The dynamics of the Dollar Index suggest a change in sentiment since the second half of February, with the DXY falling every trading session in March.

It may be too early for dollar bulls to celebrate a turning point in this protracted battle, as the US currency has been buying back on dips below its 200-day MA since the second half of January.

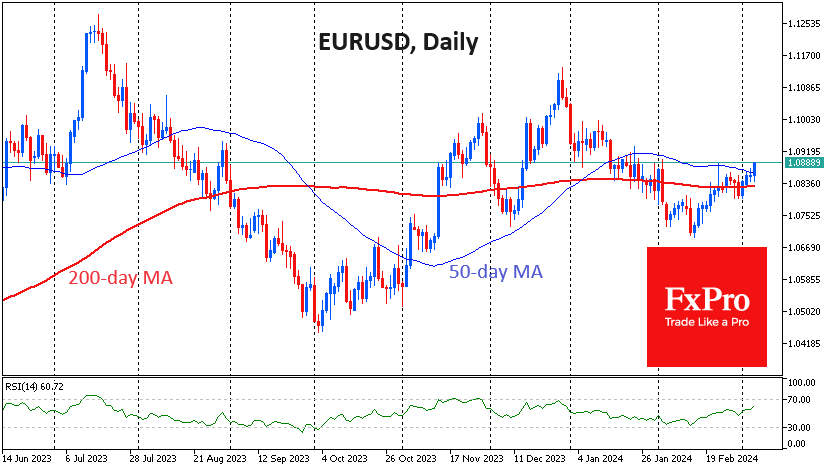

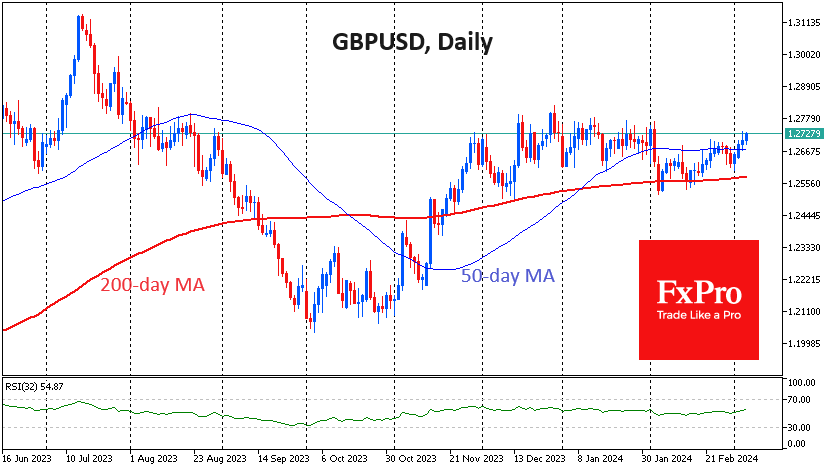

Meanwhile, the EURUSD and GBPUSD have already scored small victories, building gains above their 200-day MAs and consolidating above their 50-day averages in the early days of March.

For the USD index, a break below 103.0 will be a significant signal to break the uptrend, opening a direct path to 102 and further to 100.50. For EURUSD, momentum in the 1.0960-1.1000 area and the ability to break above the December highs at 1.11 will be important. For GBPUSD, the focus will be on the 1.2750-1.2800 area.

The FxPro Analyst Team