DAX40 and FTSE100 get support on the downturn

May 31, 2024 @ 16:05 +03:00

The US S&P500 and Nasdaq100 have declined for the past three consecutive days, with futures pointing to a negative opening on Friday. Meanwhile, Dow Jones has almost erased the gains of the first half of the month, losing for the past ten days. However, European indices are adding, clinging to significant support levels and staying within an upward trend.

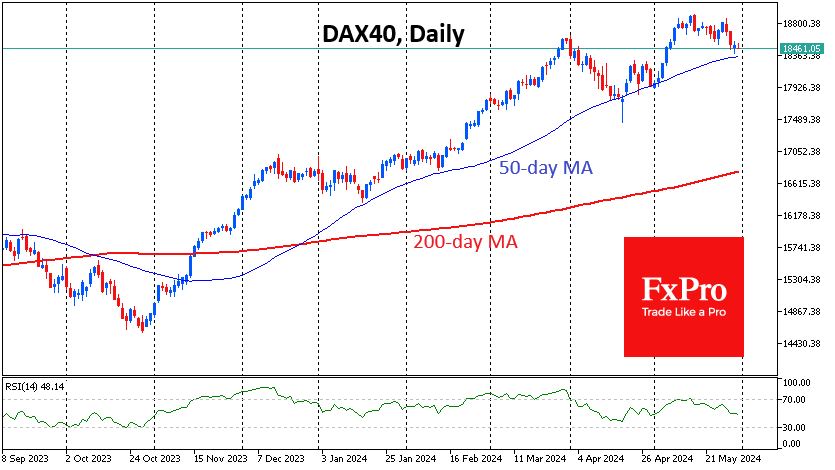

Germany’s DAX40 pulled back to its 50-day moving average earlier in the week, where buying activity intensified. Touching this line could be the fifth time since the beginning of the year which attracted bargain hunters. At this point, we can state at least a pause in the sell-off. The index near 18500 has now pulled back to the area of the previous peak at the end of March.

Under this scenario, the DAX40 will then aim to renew historical highs and overcome 19000.

The alternative scenario will be triggered in case of a sharp failure of the index under 18350, where the 50-day average now runs, which will be the first signal of the start of the correction. A move below 18250 would be the confirmation.

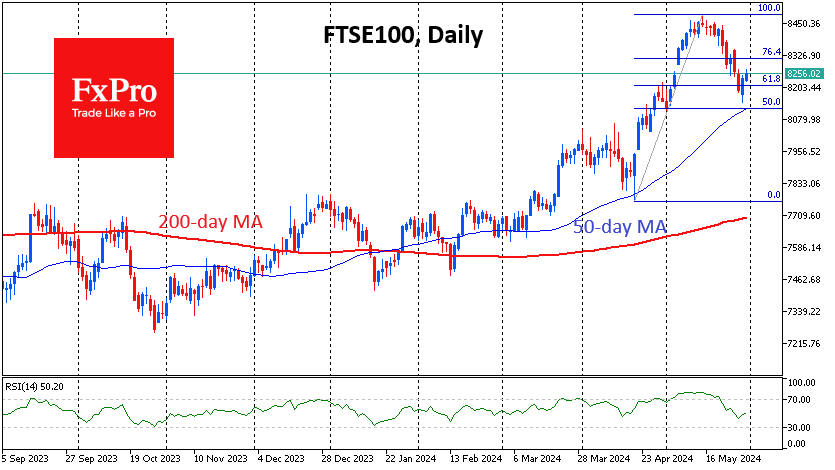

The British FTSE100 is showing even more revival, having added almost 1.5% to the lows at the start of the day on Thursday. Here, buyers got into the game on the approach to 8150, an area of short-term support at the end of April. Profit-taking in UK equities seems to have ended a little earlier than we expected, as we anticipated a fall to 8125, where the 50-day MA and the 50% retracement area from the rise from the April lows intersect.

If the corrective activity is indeed over, the FTSE100 could return to renewed highs above 8500 in the next few weeks.

However, it cannot be ruled out that the negativity from the US indices will drag Europe down with it and make it unable to resist this negativity. In this case, the first alarm bell would fall below 8125, and more reliable would be the FTSE100 dipping below 8100.

The FxPro Analyst Team