Currency and stock volatility update lows. Is the reversal close?

November 26, 2019 @ 17:17 +03:00

Mini-fluctuations are still going on in the markets. However, the stock markets remain upward, while in the currency market the dollar is stuck approximately at an equal distance from the upper and lower extremes of October.

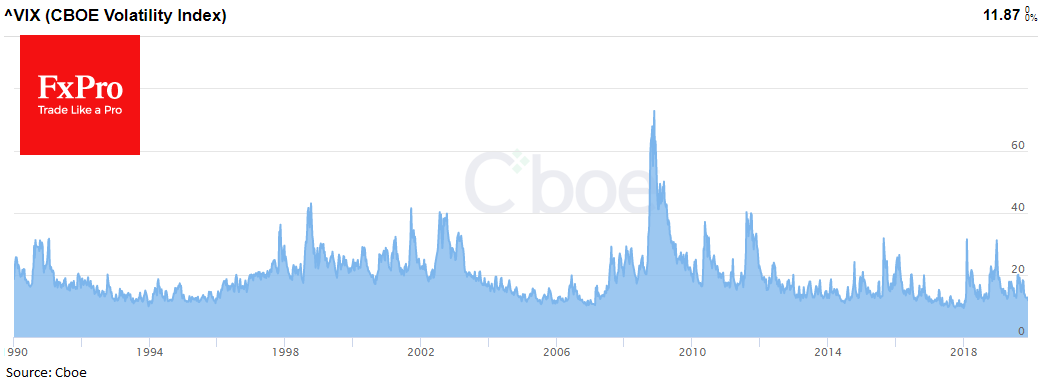

It is easy to describe this market situation as complete lull, as both intraday trading ranges and expected volatility are decreasing. The VIX index – the index of the implied volatility of the S&P500 declined on Tuesday below 12.0 – the lowest since October 2018. Immediately after touching the local lows at 11.3 for VIX, the S&P500 turned down, losing more than 20% during the next 60 trading sessions.

At the beginning of 2018, after VIX reversal from that time lows, S&P 500 experienced a 12% drop over the subsequent two weeks. However, investors should remember that a low level of volatility is not a signal to the market reversal. During 2017, VIX was repeatedly under ten, but the markets were climbing up persistently. For traders, the most prominent symptom is a sharp jump in volatility after a period of exceptional calm. So far, along with the declining volatility, the markets grew, a bit tired of this process, but not changing their direction.

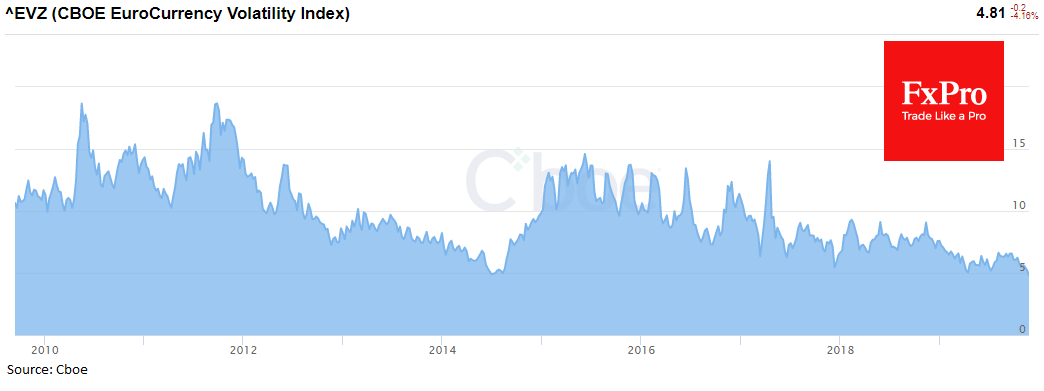

There is a quite similar situation on the currency market right now. Recently, EURUSD volatility fell to 5-year lows. Many experienced currency market traders remember that alarming calm among the major currency pairs in early 2014th. After the calm EURUSD saw a continuous and robust trend, weakened by 22% from August 2014 to March 2015.

Formally, the EVZ (EURUSD Volatility Index) does not have to grow when the EURUSD declines, but should only reflect an increase in the spread of expectations on the pair. However, over short index history (just over ten years), the dollar tends to jump sharply and decrease smoothly. So, jump in the EVZ index is likely accompanied by dollar strengthening.

If it coincides with similar dynamics of VIX, it will be possible to talk about a full-fledged escape to the protective assets and increased market turbulence.

Once again, the volatility grip continues to compress, which may keep indefinite time. A more sensible strategy for investors with VIX and EVZ perspective is to wait for a jump, rather than bet against the market trend now. One should remember that the decrease in volatility is only a sign of calming the markets, not their reversal.

The FxPro Analyst Team