Oil has been gaining for the past week after briefly dipping into the area of the lows of the year. Oil was up amid Red Sea tankers’ attacks, a crucial trade route that accounts for about 30% of trade turnover.

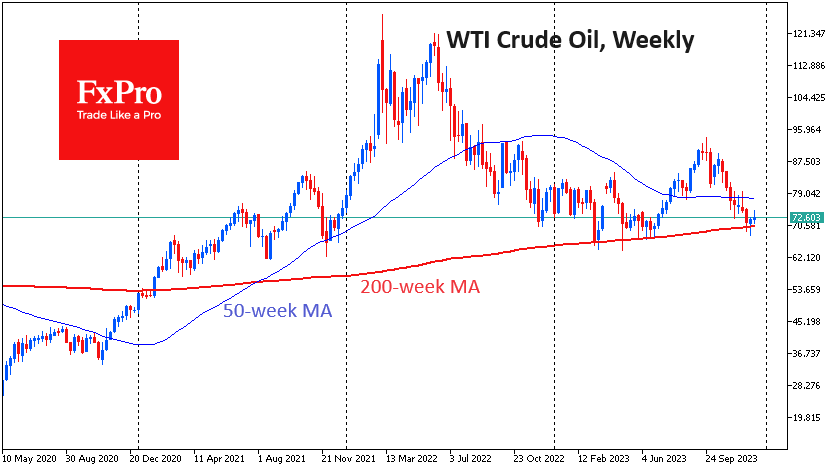

Interestingly, technical factors were also at play on the side of Oil. On the weekly timeframes, Oil got buyers’ interest after a dip under the 200-week moving average last week. That was the ninth time this year that Oil has gone below or touched that curve but closed the week higher.

It seems that OPEC+ is also looking at it as a reference point because the approach to it in 2023 coincides with verbal interventions and rounds of quota cuts. Similarly, the 200-week average worked in 2019 until Russia and Saudi Arabia’s paths temporarily diverged, and COVID restrictions amplified the magnitude to historic proportions.

On the daily timeframes, the downward price trend from the last days of November has formed oversold conditions, opening opportunities for a rebound. But we also note that the new price lows were not repeated by RSI: since October, the sell-off has stopped three times at the oversold touch at 30.

However, the bulls in Oil have yet to prove that they have turned the tide. Oil is still trading below its 50 and 200-day moving averages, underlining the downtrend.

There are economic reasons behind the pressure on Oil in the form of slowing global consumption. Behind the recent renewal of all-time highs in the US and German stock indices and India’s staggering market performance this year, it is easy to overlook shrinking or stagnant manufacturing and weak consumer demand in Europe and China.

Technically, we will see a confirmation of the upside reversal after an oil price rise above 50 and 200-day averages, which are now in the $77.5-$78.5 area and about 7% above the market. A 7% drop from current levels to $67.5 would be an essential signal of breaking the most critical support of recent years and could herald a much stronger sell-off in the following weeks.

The FxPro Analyst Team