Coronavirus to hit emerging market forex hardest in near term

March 03, 2020 @ 20:17 +03:00

Fears that the coronavirus may trigger a global downturn will hit emerging market currencies harder than developed markets in the near term as the disease spreads more rapidly outside China, a Reuters poll found. The polling was conducted before the U.S. Federal Reserve cut interest rates by a half percentage point to 1.00-1.25% in an emergency move, after G7 finance officials also said on Tuesday they were ready to use all policy tools to safeguard against risks to growth.

South Africa’s rand ZAR= is forecast to remain weak at 15.40 per U.S. dollar in 12 months after its economy was confirmed to already be in recession. The Turkish lira TRY= is expected to fall about 5% to 6.47 per dollar in the same period.

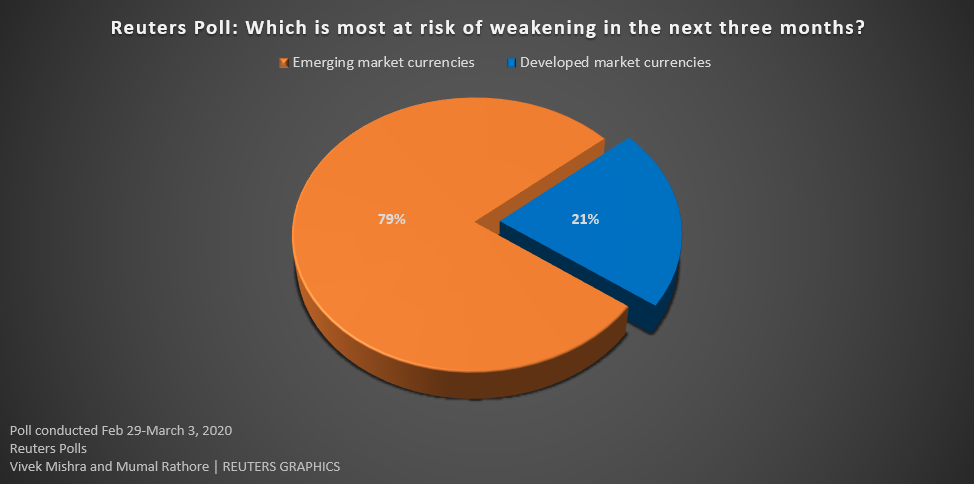

Indeed, more than three-quarters of foreign exchange strategists, 37 of 47, who answered an additional question said emerging market currencies are set to be hit harder than developed markets at least over the next three months. “Just imagine what would happen once you start seeing a global recession spreading on the back of this virus. It is not going to be favorable for the emerging markets at all.”

That had sent the Chinese yuan, the most actively traded emerging market currency, into a tailspin two months ago. It traded near a four-week high on Monday, largely reflecting the U.S. dollar’s biggest one-day drop in more than a year. But the dollar’s strength was forecast to continue in the near term, according to the wider poll of currency strategists. Central banks are now making efforts to mitigate risk from the virus outbreak. The Reserve Bank of Australia became the first in the developed world on Tuesday to slash interest rates since the outbreak went global.

Coronavirus to hit emerging market forex hardest in near term, Reuters, Mar 3