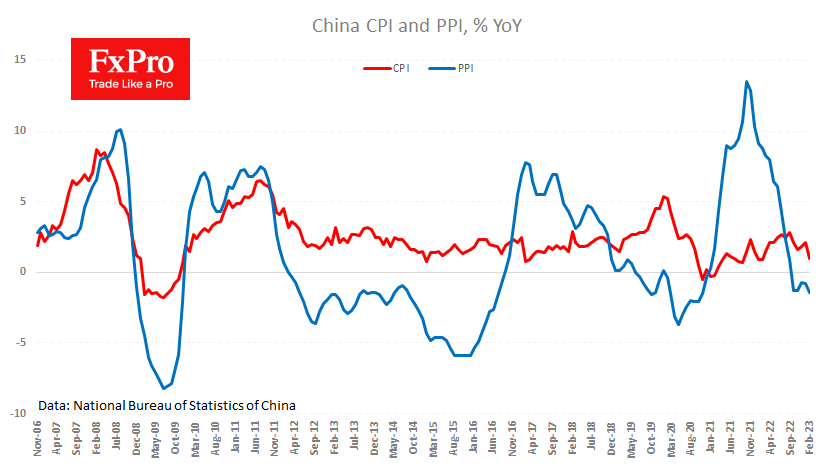

China’s consumer price growth fell to 1.0% y/y, a sharp slowdown from 2.1% y/y and against expectations of 1.9% y/y. Producer prices continued their deflationary slide in February, falling 1.4% y/y, versus -0.8% in the previous month and a slightly stronger than expected 1.3%.

The opening up of the Chinese economy has a deflationary effect on the domestic economy. In contrast, easing restrictions has had a pronounced pro-inflationary impact in Europe and the US. This effect is easily explained by the fact that the Middle Kingdom remains the “world factory”, and the opening of the economy boosts the supply more than the demand, which also helps to restore supply chains.

Over the past 20 years, China has been blamed for the spread of global deflation. In the current situation, this is a desirable side effect. Falling producer prices are also likely to help contain the global inflation problem. This is good news for risk demand, even if it does not appear so at first glance. Often, weak price pressures are associated with low demand. We have yet to see the February retail sales figures next week, but it is unlikely that the lifting of closures will suppress demand.

If we are right and the price fall is a sign of a return to the Chinese norm, this should support equity prices and the renminbi exchange rate.

The FxPro Analyst Team