Chinese and US stock indices maintain growth as yield curve normalization aids the markets

April 03, 2019 @ 12:06 +03:00

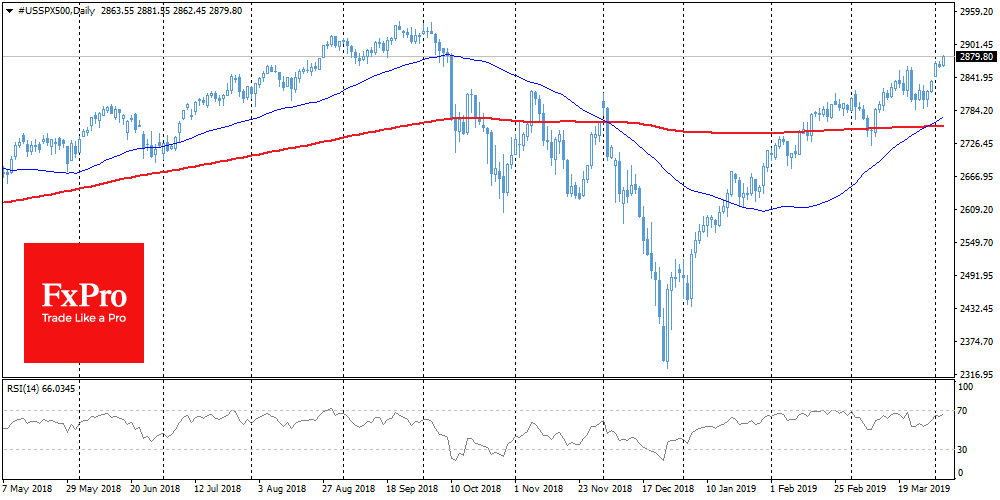

Stocks Chinese and US stock indices maintain growth impulse, adding 0.3-1.0% within 24 hours, reflecting the demand for risky assets. The Chinese blue-chip index A50 fully offset the last year decline due to trade wars fears. S&P 500 reached the highest levels since October 10, 2018, when the market collapsed due to the Fed’s tough comments. Among the macroeconomic news, China’s service PMI growth is higher than expected after strong production data at the beginning of the week.

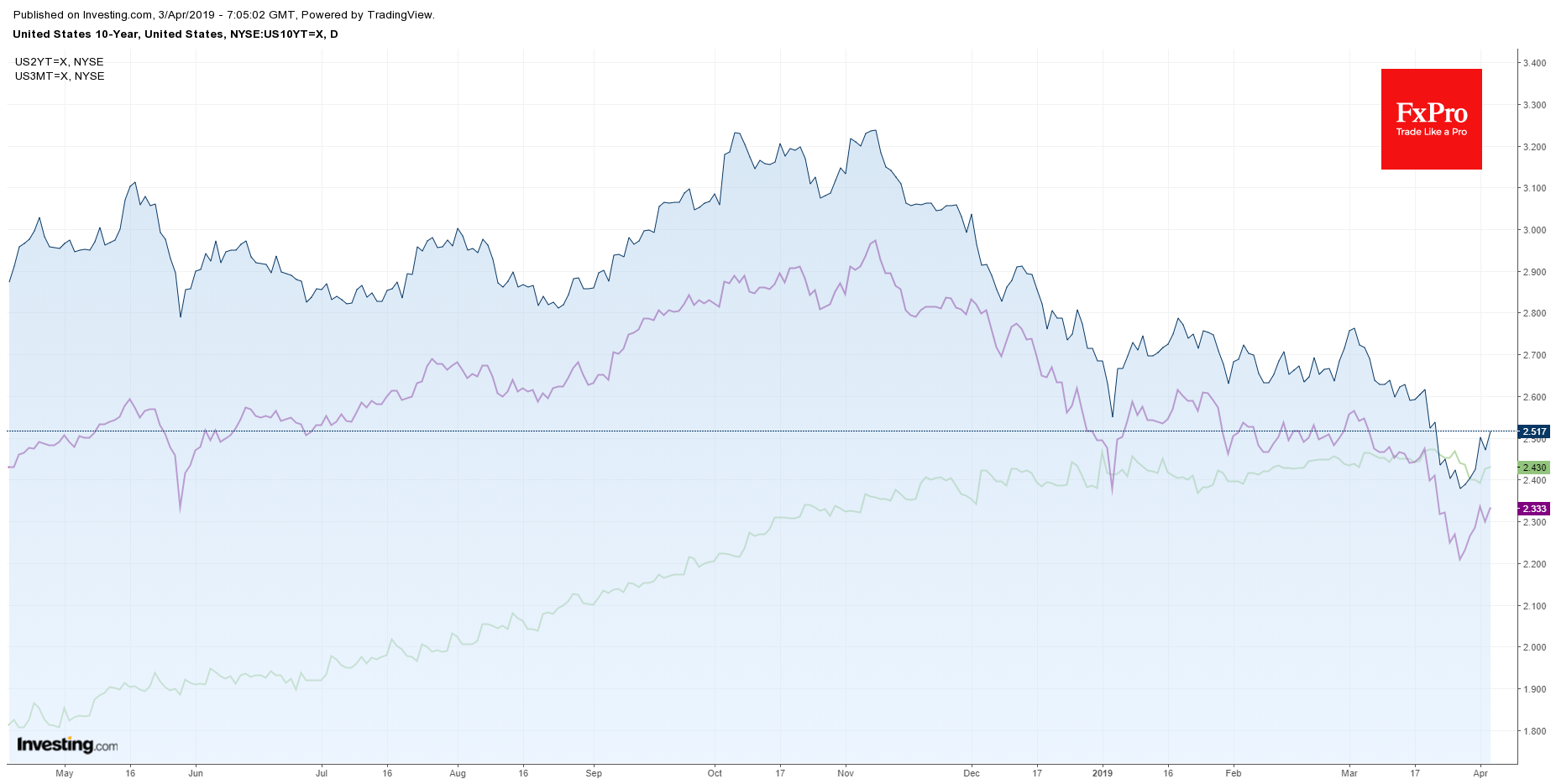

Debt markets The yield on US 10-year government bonds is growing again, exceeding 2.5%. The yield of 3-month treasuries is at the level of 2.43%. Maintaining a positive spread between 3-month and 10-year bonds allows markets to sustain demand for risk.

Alexander Kuptsikevich, the FxPro analyst