China-US trade wars undermine Eurozone manufacturing

July 05, 2024 @ 17:30 +03:00

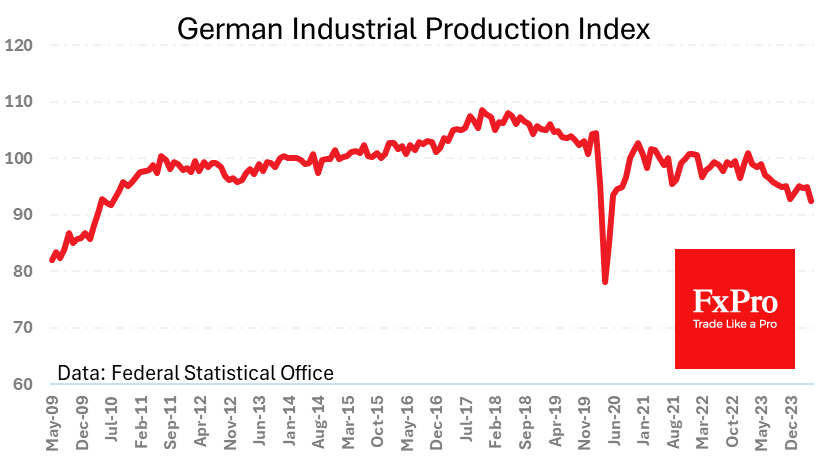

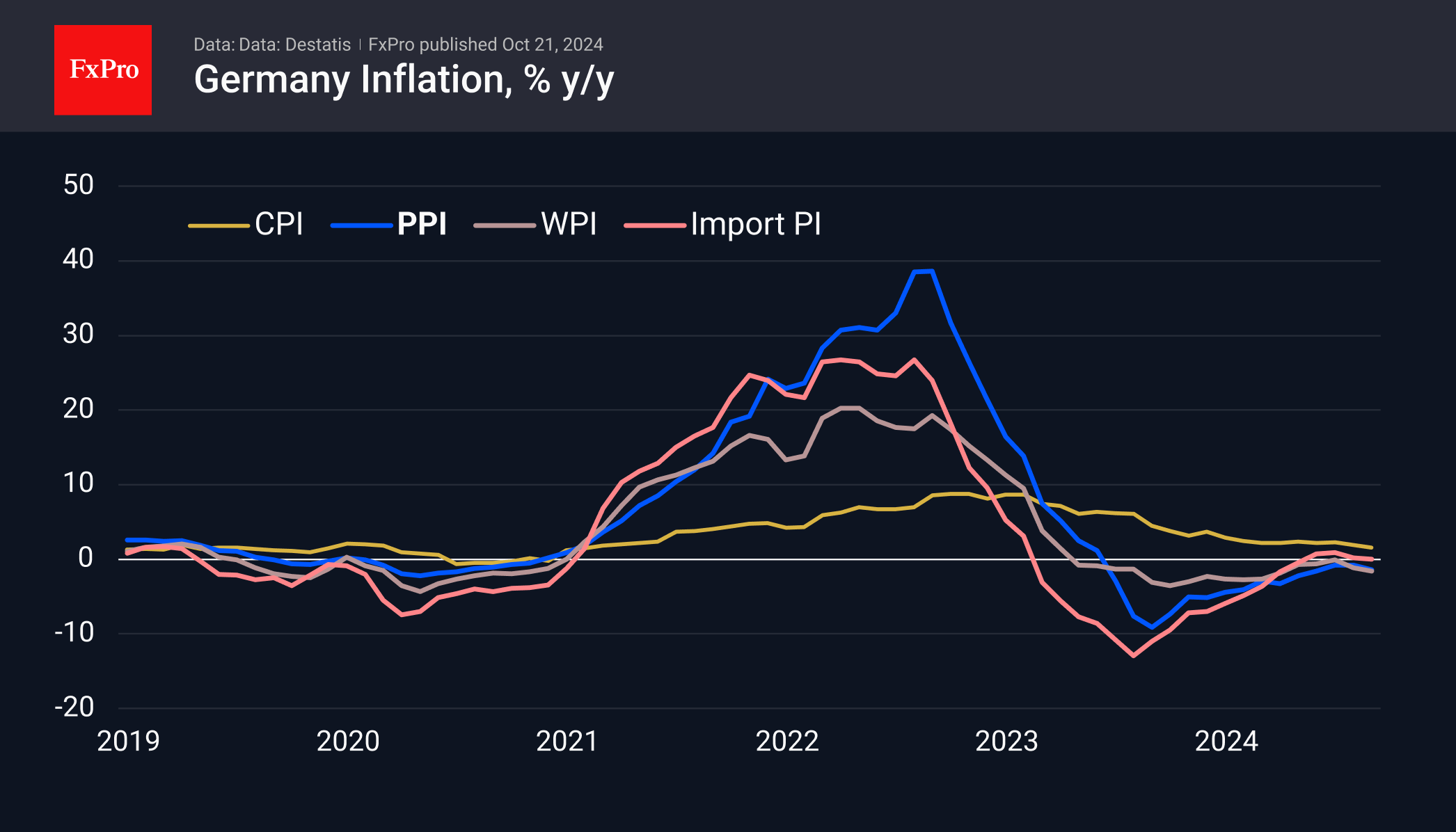

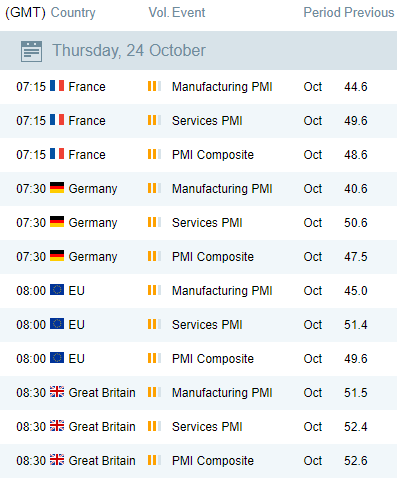

Industry in the Eurozone is under pressure. Germany’s industrial production index plunged 2.5% in May. By the same month a year earlier, the loss was 6.7% – the worst result since August 2020. Excluding the failure at the start of the pandemic, the industrial production index is at its lowest point since mid-2010. The degradation began in 2018 with the first salvos of Trump’s trade wars and accelerated early last year. In both cases, the catalyst for the deterioration was the US-China trade wars, which hurt Germany up the chain. At the same time, Europe’s economy has found it harder to rely on domestic demand because of the sharp rate hikes that started two years ago.

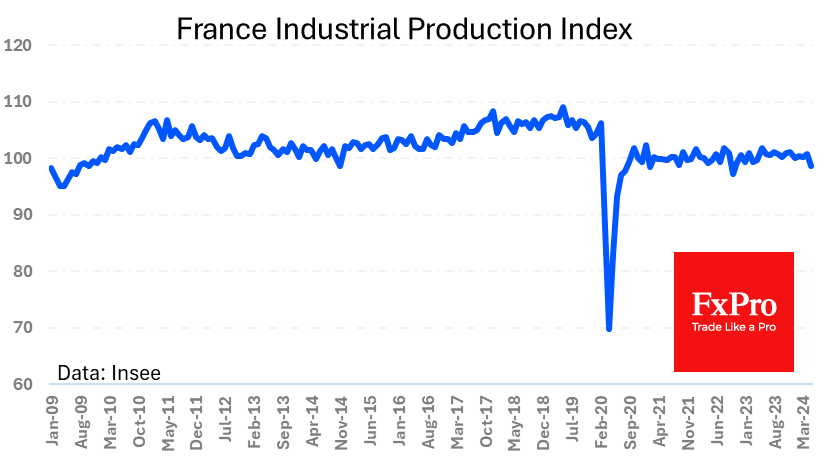

French manufacturing is also under pressure, contracting 2.1% in May and down 3.1% from the same month a year earlier. France’s industrial production index has been stagnant since the end of 2020, roughly in the region of the 2014 lows. As in Germany, a long-term downward trend was signalled in 2019. However, the index peaked in April 2008, losing about 20% since.

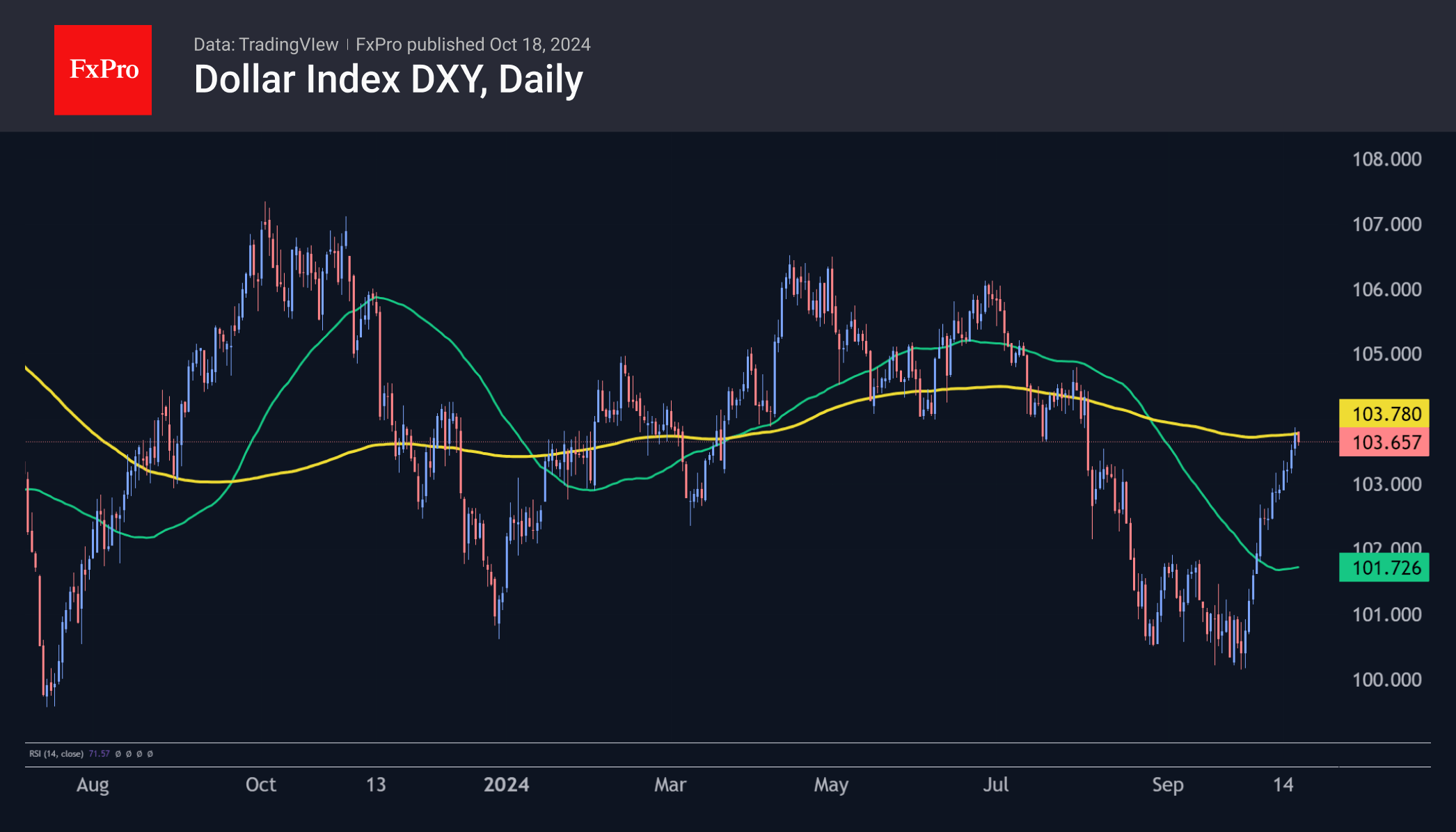

This is potentially negative news for the single currency, although the reaction can only be seen against the pound and the yen, as the global FX is dominated by pressure on the dollar.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks