The Canadian dollar rallied on the release of January’s employment figures. However, it will be difficult to sustain the gains and build on the offensive if we focus only on the data released.

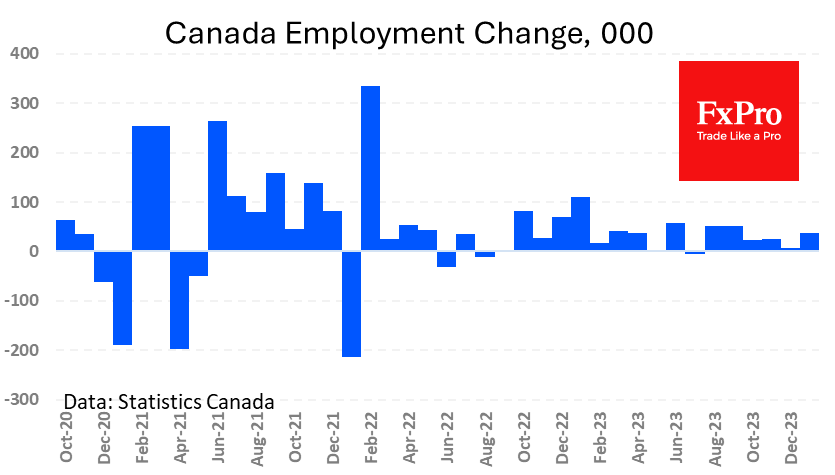

According to StatCan, employment grew by 37.3K last month, vs. the expected 16K. The unemployment rate fell from 5.8% to 5.7% instead of the expected rise to 5.9%.

However, it is worth digging a little deeper into the figures to find a more worrying picture. A surge in part-time employment contributed to the overall increase. In January, there was an increase of 48.9K, after a rise of 14.4K in the previous month. At the same time, full-time employment fell in both December (-7.5K) and January (-11.6K). The shift of the labour force into part-time employment seems to be a sign of employers’ caution.

The fall in the unemployment rate is a consequence of the share of the economically active population falling from 65.4% to 65.3%. This is the lowest level since September 2022. Except for the pandemic, labour market participation has not been this low since the end of 1999.

The FxPro Analyst Team