Can the post-election rally be sustained?

November 06, 2020 @ 13:38 +03:00

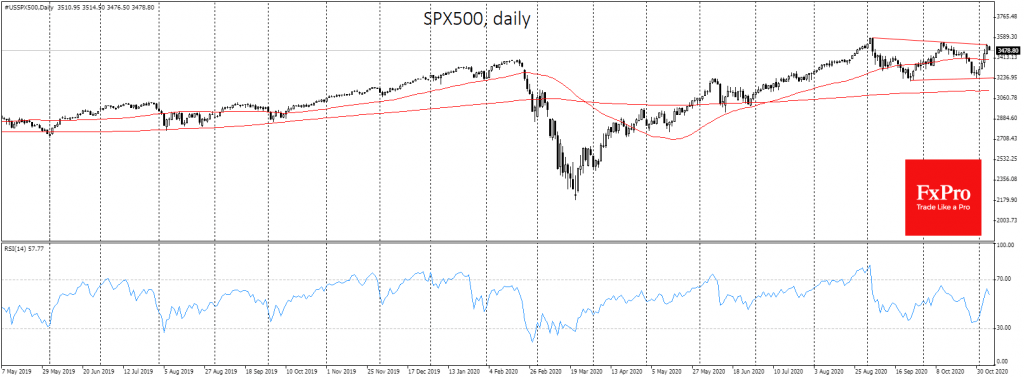

World markets are on their way to what will be their best performing week in many months. Close to its best week since April, Futures for the S&P500 are up 6.8%, staying close to 3500, regaining the fall of the previous three weeks. The S&P500 and Nasdaq100 have again reached historic highs during the post-election rally, however, there was a slight slip in both on Friday morning, which can be attributed to the end of the week profit-taking.

The growth driver is the expectation that as President, Biden will reduce the intensity of trade disputes with China and other important trading partners. At the same time, the Republican Congress will block Biden’s tax hikes.

But this seems to be too weak a fundament for rallying markets.

First, the results of the presidential election are yet to be finalised and are likely to be disputed.

Second, there is a real risk that a divided Congress will argue for too long about a new relief package that has already been delayed since July.

Third, as the Fed noted at yesterday’s meeting that the economic recovery is losing momentum and we received confirmation of this earlier in the week. The ADP report noted that the private sector created only 365K last month and the Service Employment Index fell close to the ‘waterline’ at 50.1. Besides, the number of initial weekly benefit claims has changed little over the past four weeks, reflecting weak progress in labour market recovery.

These reports are a dire warning before today’s NFP publication. Market analysts expect on average an increase in employment of 600K in October. However, this may prove to be too optimistic a forecast.

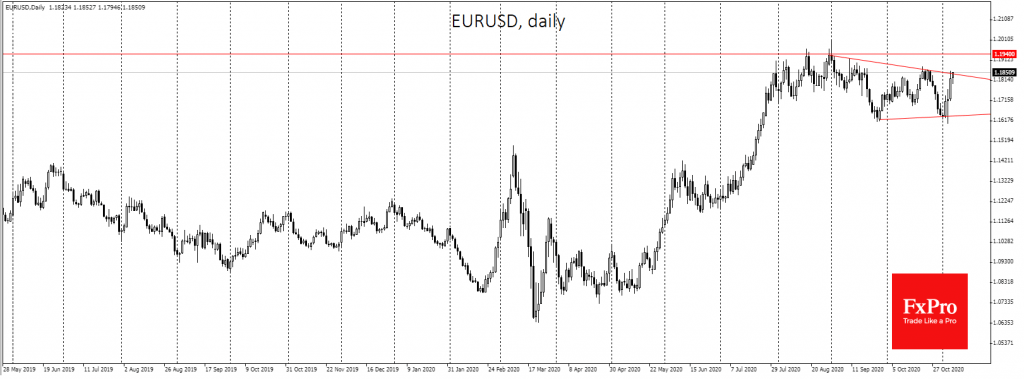

Against this backdrop, the dollar could again be under pressure if the labour market report is weak, as softening recovery will require the Fed to support the economy practically on its own by increasing asset purchases.

On the world markets, there are bonds worth $17 trillion with below-zero yields and this is just the tip of the iceberg, as many central banks are targeting yields just above zero, disrupting the market.

Speculators are rushing to use this trend to their advantage, running ahead of the Central Bank in bond purchases and compensating for the decline in yields with riskier assets such as emerging market equities and currencies. This is rather like attempting to pick up pennies in front of a steamroller.

Almost the entire world economy remains at risk of another decline in the fourth quarter. Politicians, however, are much less willing to give away money by issuing bonds, giving the situation away to central banks. The conditions may turn around quickly and firmly at any time, threatening to cause a sharp increase in turbulence.

The FxPro Analyst Team