Buying Gold: ugly short-term deal, promising for long-term

March 16, 2022 @ 12:42 +03:00

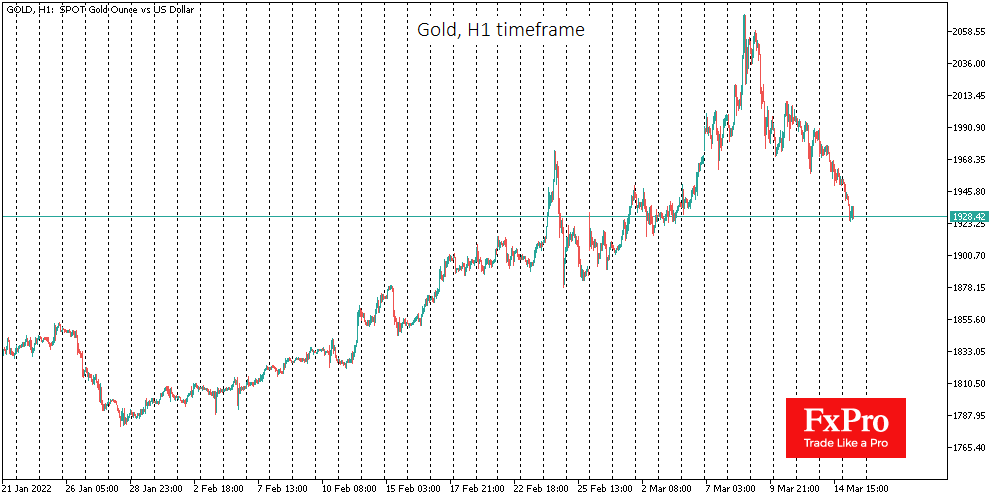

Gold loses another 1% on Tuesday, pulling back to $1933 and settling around $1920 on Wednesday morning. About one week ago, quotes were soaring towards $2070, but they have been in a steady downward trend since then. The short-term charts clearly show the even pressure crystallising since March 10th.

It may seem illogical that the gold price is down, pending reliable signs of military de-escalation. Rampant inflation should also contribute to the demand for Gold as protection against capital depreciation.

The answer to this question seems to be sought in the altered gold supply balance. Likely, the Bank of Russia is now actively selling Gold from its reserves, both domestically and using the remaining means to do so abroad.

In the short term, this creates an impressive market overhang, despite data confirming that exchange-traded funds have built up their holdings in the metal to a record.

If the current trend develops, the price of Gold could deflate into the $1850-1870 area, where it was before Russian troops entered Ukraine.

That said, buying Gold remains a prudent long-term strategy. Geopolitical instability forms the risks of a slowdown in the economy, which will deter the Fed and other major central banks from tightening policy. A 25-point rate hike is expected from the Fed this week, although the markets gave more than a 60% chance of a 50-point hike at once in the first weeks of the year. In the meantime, the current and expected price situation has only worsened, accelerating the actual depreciation of assets.

Looking ahead to the next few months, a very supportive environment remains for gold prices up to around $2,500. The marginal forecasts of a new round of gold growth are also becoming more evident, echoing the dynamic of the 1970s, as the energy and food markets are now in a very similar position. If this holds true, the price could soar several times in the next several years.

The FxPro Analyst Team