Bitcoin collapsed on Thursday, the most in almost a month amid sales of risky assets. BTC lost 7.7%, ending the day near $40,700. Ethereum fell 7.7%, while other leading altcoins from the top ten also fell, from 5.4% (Binance Coin) to 8.5% (Terra).

The total capitalization of the crypto market, according to CoinGecko, sank by 7.3%, to $1.94 trillion. Bitcoin sold more actively than altcoins, which led to a decrease in the Bitcoin dominance index by 0.3%, to 39.8%. The Cryptocurrency Fear and Greed Index plummeted 22 points to 30, returning to a state of fear.

Bitcoin has clearly lost its function as a defensive asset lately, showing almost no correlation with gold, which was in high demand on Wednesday and Thursday.

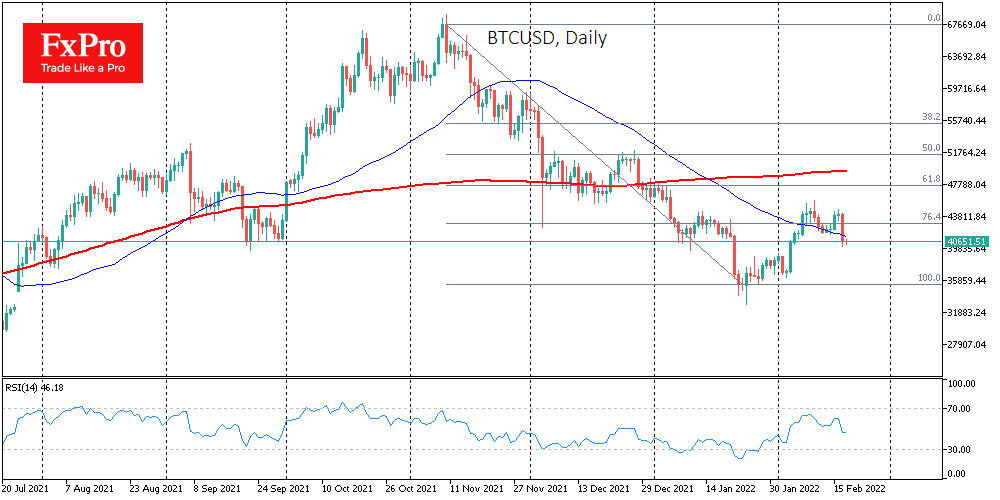

The technical picture looks bearish in the short term. Bitcoin did not hold above the 50-day average and fell under previous local lows. It is quite possible that from the end of January to mid-February, we saw a pullback after the momentum of the decline, and now a new step down is being formed.

JPMorgan Bank indicated that crypto assets would be negatively affected by tightening US monetary policy. This approach puts crypto on a par with growth companies, which have also come under increased pressure amid rising market interest rates in recent weeks.

Charles Munger, an associate of legendary investor Warren Buffett, likened cryptocurrencies to a “venereal disease” and praised China for banning them. According to him, cryptocurrencies are used by hackers, criminals, as well as those who evade taxes.

The FxPro Analyst Team