USDJPY jumped more than 2% after comments from the Bank of Japan’s deputy governor reduced the chances of further policy tightening soon. Uchida said that the central bank will not raise interest rates when markets are unstable. These words brought buyers back into the Japanese markets and helped USDJPY to extend its 4% rebound from Monday’s lows.

It is interesting to note that yen speculators did not initially appreciate the Bank of Japan’s rate hike from 0.1% to 0.25%, as the yen lost around 0.6% in the first hour after the decision. But this change in fundamentals triggered an unwinding of the carry trade and was an important factor in the pressure on markets at the start of the week.

At the same time, these words were meant to calm the markets but not reverse the course of monetary policy, especially as both Japan and the US are normalising interest rates. In Japan, inflation has been close to the 2% target for almost two years, allowing the central bank to end a period of zero interest rates. Meanwhile, the Fed is grappling with slowing price growth and a cooling labour market, forcing a move to a long-term average rate of 2.8% (as estimated by the FOMC) from the current 5.25-5.50%.

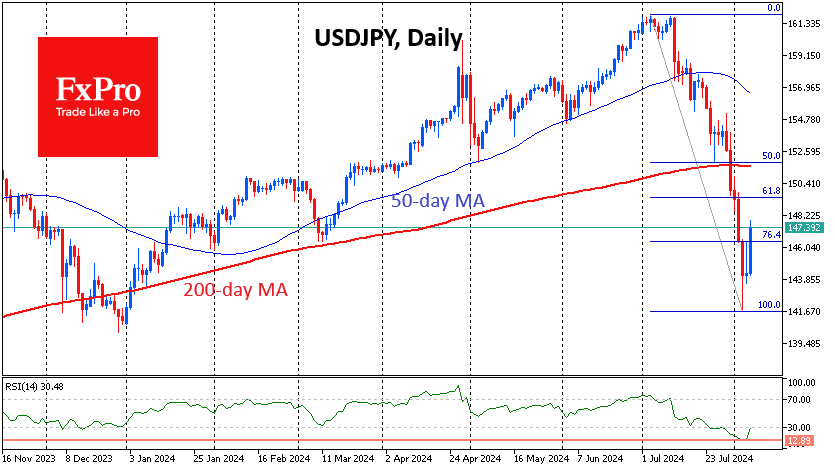

Technically, the USDJPY’s current rise looks like a necessary bounce from extreme oversold conditions. In the daily timeframe, the RSI dropped to 13, a low previously seen in 1997 and 1995. In both cases, the bounce was followed by fresh bearish momentum and the lows were updated before the pair made a long-term reversal.

The USDJPY could potentially bounce back to the 149.50 area, which is near the 61.8% Fibonacci retracement level – a classic retracement. However, in these earlier instances, the markets were content with less severe pullbacks to 76.4% (in our case, near 146.5), so we do not rule out the possibility that the pair’s recovery momentum could fade quickly later today.

The 146.0-146.5 area acted as support in February and March, and now it has every chance of becoming resistance, which could keep the pair from moving higher for a long time.

However, this bearish view on the USDJPY’s prospects should be corrected if the pair manage to break above 149.50 in the coming days. A break above the 200-day average of 151.60, below which the pair fell following the Bank of Japan’s decision to raise interest rates, would confirm this.

The FxPro Analyst Team