The black streak in US data continues. A sharp jump in weekly jobless claims was paired with a weak PPI, complementing the soft consumer inflation report the day before.

Manufacturers cut prices by an average of 0.2% in May, and the annual rate of PPI growth fell from 2.3% to 2.2%, contrary to the expected acceleration of 2.5%. Core PPI slowed from 2.5% to 2.3%. The unexpected slowdown in PPI growth calls into question the upward trend we have seen since the beginning of the year. It also increases the chances of a further slowdown in consumer prices in the coming months.

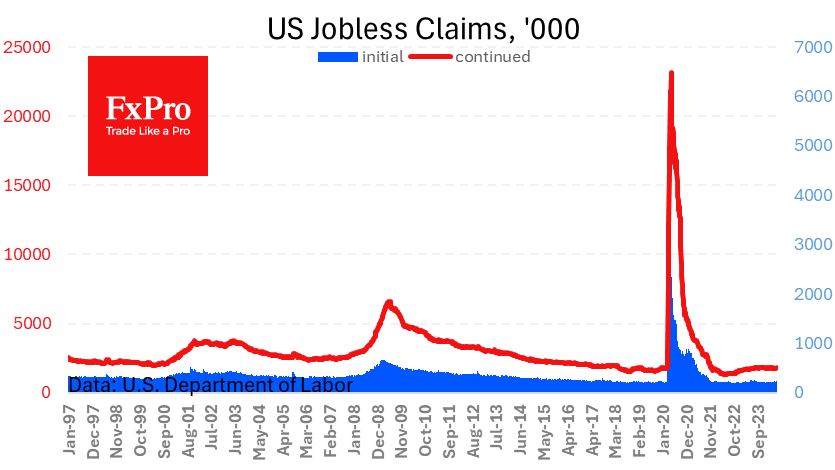

The other dose of bad news is the jump in weekly unemployment benefits claims. That figure rose to 242k, the highest since last July. The trend has been up there since the beginning of the year. Many see this as an important first signal of a turnaround in the labour market.

The impression is that the economic cycle in the US has already turned, and the Fed, looking for evidence of this, is trailing the cycle, being late in making monetary policy changes. It may well be that already in September-October, we will see a net reduction in employment, and then the Fed will again have to adjust the course in a hurry – this time, to a softer tone.

The FxPro Analyst Team