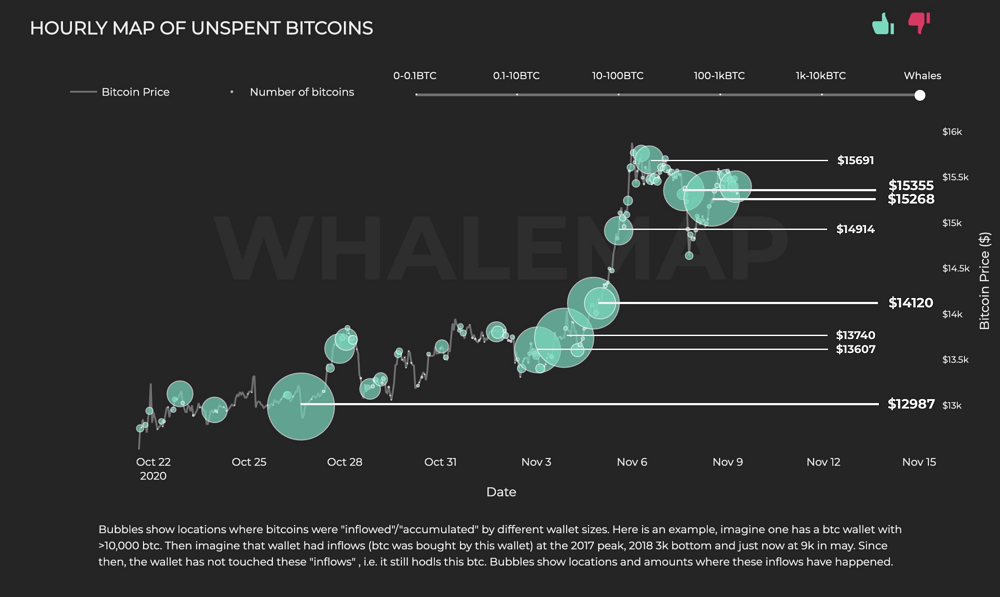

New data from Whalemap suggests that in order to maintain bullish momentum Bitcoin price needs to hold above the $14,914 level. Whale clusters, like the bubbles shown on the chart below, form when high-net-worth investors purchase Bitcoin and do not move them. This indicates that whales accumulated BTC at that level and suggests that it will likely remain as a support area in the event of a correction.

As such, in the near term, it is crucial for Bitcoin to remain above $14,914 for a prolonged period. It would signify consolidation under a multiyear resistance at $16,000 and stability above a major support level. Throughout the past week, Bitcoin has seen unusual price action and been quite volatile in a broad range.

From Nov. 6 to Nov. 9, BTC tested the $16,000 level twice and fell to as low as $14,350. This short-term volatility was likely connected a range of macro events, including the ‘contested’ U.S. election results. There have been a number of big risks in the market since early November. The election risk noticeably benefited Bitcoin as investors sought out safe-haven assets. Then, Pfizer’s vaccine breakthrough became an unexpected variable, causing Bitcoin and gold to plunge.

Despite these uncertainties, Bitcoin has remained comfortably above $13,600, a level which Whalemap analysts pinpointed. They wrote: “New levels that formed over the weekend! If we start ranging this should be a good guide to what the levels should be. Price should stay above ~$13,600 to continue the bull run.”

In the short term, the $13,600 to $14,914 range remains the most important for Bitcoin’s rally to continue. So far, the momentum of BTC has been relatively strong, considering that miners have been selling. As Cointelegraph previously reported, CryptoQuant CEO Ki Young Ju said in an interview that miners have been selling Bitcoin. Based on the resilience of BTC, new buyer demand likely countered the selling pressure coming from miners.

Bitcoin whale clusters signal $14.9K is the crucial level for BTC to hold, CoinTelegraph, Nov 11