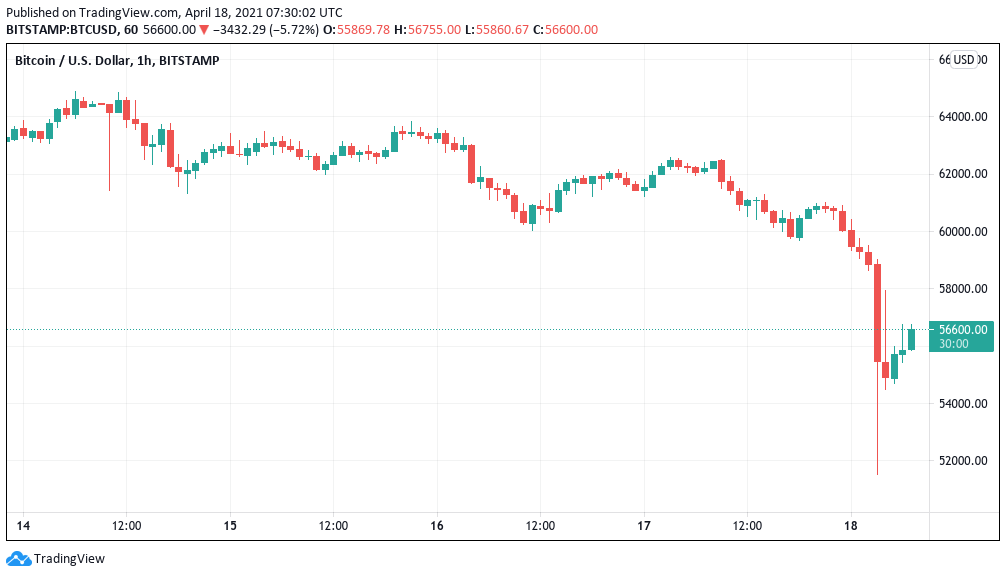

Bitcoin (BTC) fell to sudden lows of $52,000 on April 18 in a timely reminder of how price action often follows hash rate. Cointelegraph Markets Pro and TradingView showed a brutal hour for Bitcoin bulls everywhere early on Sunday as the market went from $59,000 to $52,000 in minutes. Having lost $60,000 support earlier in the weekend, BTC/USD was still fairly stable before the snap price event, which liquidated positions worth almost $10 billion over the past 24 hours.

At around $7,000, the hourly loss challenges the record reversal seen in February after Bitcoin hit $58,000 for the first time. In the aftermath, analysts pointed to two events as potential causes: a hash rate crash and rumors from unnamed sources that United States regulators were about to charge unnamed “financial institutions” with crypto-related money laundering.

Hash rate — an estimate of the computing power dedicated to the network by miners — crashed by almost half according to some estimates. This was due to a mass outage in China’s Xinjiang province, home to a large number of miners, which began two days ago.

In a classic depiction of the old adage, “price follows hash rate,” BTC/USD then caught up with reality. “Price and hash rate has always been correlated,” statistician Willy Woo argued, pointing to a similar event from November 2017. Woo added that as then, the impact on price action was temporary and that hash rate had meanwhile already “almost fully recovered.”

Bitcoin price drops to $52K, liquidating almost $10B, CoinDesk, Apr 19