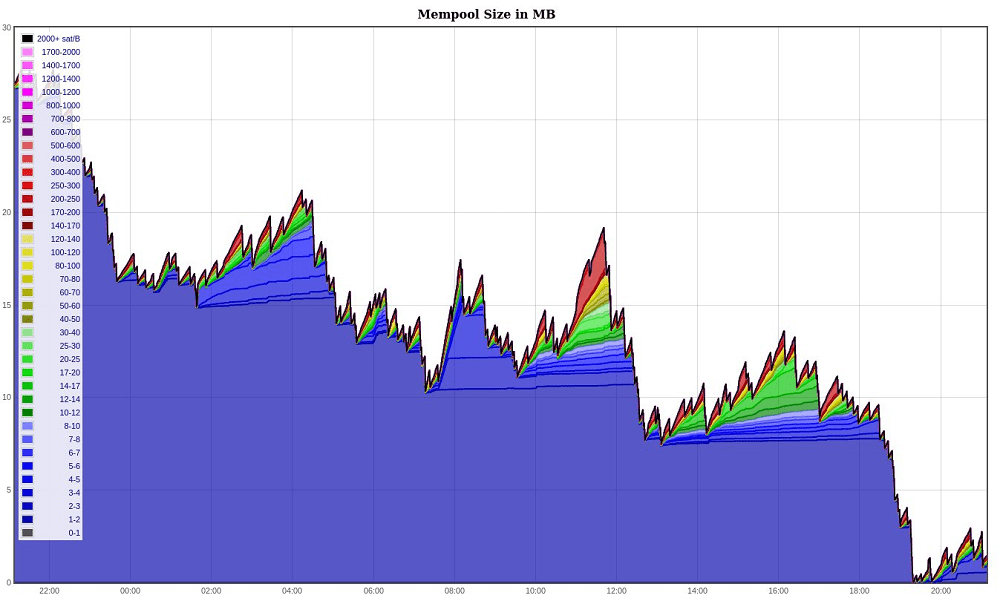

The Bitcoin network mempool shrank to its smallest size since mid-October this week after the network’s hash power soared. The clear mempool meant that that thousands of stuck transactions pending confirmation were included in recent blocks, leaving very few unconfirmed transactions still outstanding.

The spike in hash power has been attributed to the re-activation of China-based miners who migrated from Sichuan after the end of the province’s rainy season. Bitcoin’s hash rate increased by 42% over a two day period, Nov. 9 and 10.

A smaller mempool is good news for regular Bitcoin users as it reduces competition among fresh transactions to get included in upcoming blocks. Reduced competition in the mempool helps to drive down Bitcoin transaction fees, as miners can potentially include all transactions in the mempool irrespective of their individual fee amounts.

Average Bitcoin transaction fees reached a peak of $13.16 per transaction on Oct. 30, when more than 140,000 transactions were pending in the mempool. The influx of new hash power over the weekend allowed Bitcoin blocks to be found faster than the benchmark speed of 10 minutes per block due to the network’s relatively low mining difficulty. This allowed miners to reduce the number of unconfirmed transactions to zero on Nov. 9.

As of this writing, there were approximately 6,000 transactions in the mempool with a median fee of 3 satoshis per byte (sat/byte) or roughly $0.11. Some users have reported fees as low as 1 sat/byte for transactions that have confirmed within a few hours.

Mining difficulty was expected to increase upon the next adjustment to account for the network’s increased hash power, which would mean the current respite from high fees may be short lived. However the hash rate is currently volatile and has dropped 37 EH/s in the past day.

Bitcoin fees plummet as mempool clears to zero, Cointelegraph, Nov 11