The Chinese yuan, which has steadily strengthened this year, spiked even further in the days leading up to and after Joe Biden’s projected election victory. Analysts have flagged that a Biden win is likely to be more bullish for the Chinese currency. And indeed, investors seem to think so.

As Biden’s victory seemed to grow increasingly likely last week, the offshore yuan rallied to below the 6.60 mark. It hit a 28-month peak on Monday after he became the projected winner and appreciated even further after.

“Ostensibly, (offshore yuan) reactions suggest that a Trump victory is deemed to be far more negative for China, in contrast to a Biden Presidency, seen to lend some semblance of stability and interim relief,” Vishnu Varathan, head of economics and strategy at Mizuho Bank, wrote in a note late last week. He noted U.S. President Donald Trump takes a “unilateral, zero-sum game approach that has turned increasingly antagonistic and unpredictable.”

While Biden shares concerns about the geopolitical and technological threat that China poses, the former vice president is “likely to adopt multilateral and rules-based engagement,” Varathan wrote.

Still, analysts say that the outlook for the yuan isn’t purely strength gained on optimism for the Biden administration, but includes a myriad of factors, including geopolitical motivations, a weaker dollar and China’s economy.

With more U.S.-listed Chinese companies flocking back home to Shanghai or Hong Kong to launch secondary listings, a “significant portion” of those flows have been conducted in the yuan rather than the dollar, according to ANZ Research.

Overall, cross-border settlements using the renminbi (RMB) — another name for the yuan — amounted to 19.67 trillion yuan ($2.97 trillion) in 2019, increasing 24.1% from the previous year, according to a 2020 report by the People’s Bank of China (PBOC). In 2019, the RMB settlement between China and countries in its mammoth Belt and Road initiative accounted for 13.9% of total global settlement – a year-on-year jump of 32%.

The report said that, by the end of 2019, China had signed bilateral local currency swap agreements with 21 countries as part of its Belt and Road initiative. The ambitious project aims to build a complex network of rail, road and sea routes stretching from China to Central Asia, Africa and Europe. It is also aimed at boosting trade.

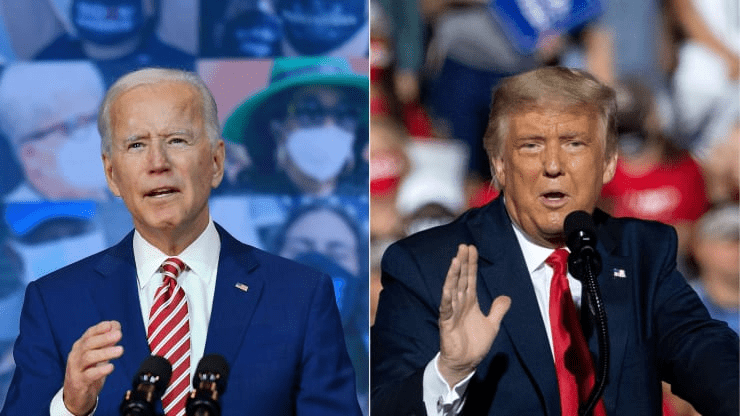

Biden’s win boosts the Chinese yuan, but the Trump effect will be more lasting, CNBC, Nov 13