The pause in the currency market is dragging on. Over the past two weeks, the Dollar Index has risen 0.15%, although intraday volatility has been within normal limits. This is by no means a balanced market but rather a manifestation of a wait-and-see attitude.

Wednesday evening is the next FOMC meeting on monetary policy. No changes are expected, but everyone will be watching the wording of the official commentary and Chairman Powell’s answers to questions about the outlook for monetary policy.

A month ago, markets were 90% certain of a rate cut in March. Today, that probability is estimated at 45%. Much of this reassessment has taken place in the last two weeks. Still, it has yet to be reflected in the dollar index rate.

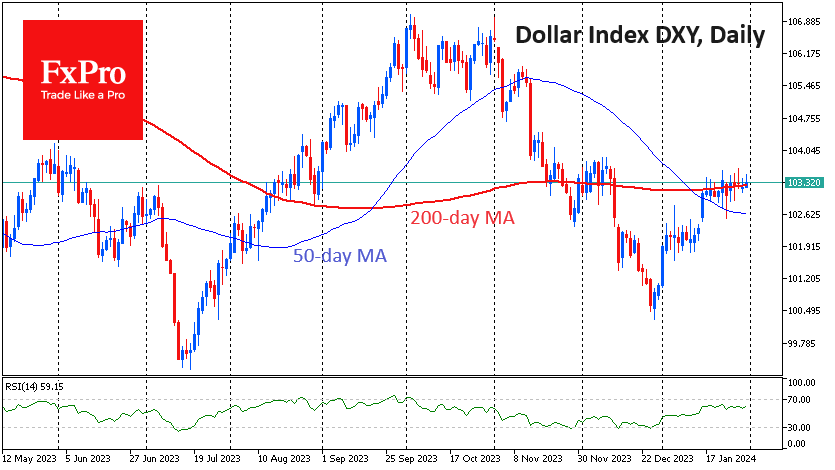

The stabilisation at current levels is also notable from a technical perspective. The Dollar Index is hovering around its 200-day moving average, which is a strong trend indicator for the major players.

Moreover, at the current level of 103.30, the DXY has given back about half of the amplitude of the decline from 107 in early November to 100.3 in late December. The decline began as the Fed signalled the end of its hiking cycle and reached a tipping point when FOMC members began to express overly optimistic expectations about the timing and speed of rate cuts.

The last fortnight has paved the way for a strong move with little indication of direction. Traders should not rush to take sides ahead of Wednesday’s or Friday’s news and join what is likely to be a prolonged trend.

If Powell’s comments reinforce the expectations for a quick and sharp rate cut that have been forming in investors’ minds since the end of last year, the dollar could start to move towards the 95-97 area. The dollar could also return to 90, the area of the 2021 and 2018 lows, within a couple of years.

If the Fed were to adopt a dovish stance, citing upside risks from a strong labour market or fears of repeating the mistakes of the 1980s, this could be the starting point for a dollar rally. Potentially, the US currency would be on its way to the late October high of 107, with a chance of rising to 113 in the two-year outlook.

The FxPro Analyst Team