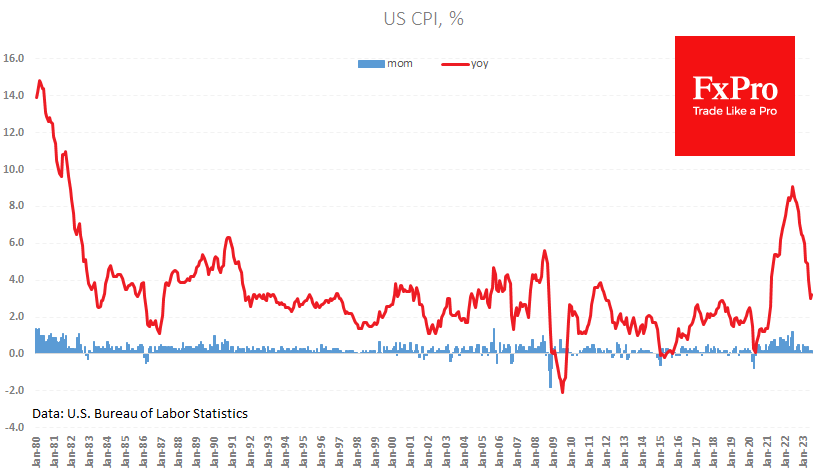

US CPI rose 3.2% y/y, slightly weaker than the 3.3% y/y expected. Core inflation slowed to 4.7% y/y, although analysts, on average, were looking for it to maintain its 4.8% y/y pace.

This is negative news for the USD and positive for equities as it allows the Fed to soften its rhetoric. The odds of a rate hike at the end of September fell to 7.5% immediately after the report, down from 14% the day before and over 22% two weeks ago.

The Dollar Index is down 0.4% on the day and briefly dipped to 101.6, repeating last Friday’s lows. US stock indexes accelerated their recovery amid the release, with S&P500 futures adding 0.3% to close above 4,500.

Annual inflation continues to be pushed up by services prices (+6.1% y/y), with housing costs up 7.7% y/y and transportation costs up 9.0%. Eating out is up by 7.1%, almost twice as much as eating in (3.6%). Price increases have been tempered by declines in fuel prices (-20.3% y/y), used cars (-5.6%) and medical expenses (-1.5%). However, fuel prices show signs of a turnaround, with the index up 3.0% m/m after a 16% jump in WTI last month.

Stocks have yet to prove their ability to rally and buck the downward trend since early August. The Nasdaq100, which is a more subtle reflection of fluctuations in risk appetite, has lost over 5% from its peak on the 19th of July to the lows on the 9th of August and is now trying to cling to an uptrend in the form of its 50-day moving average.

The FxPro Analyst Team