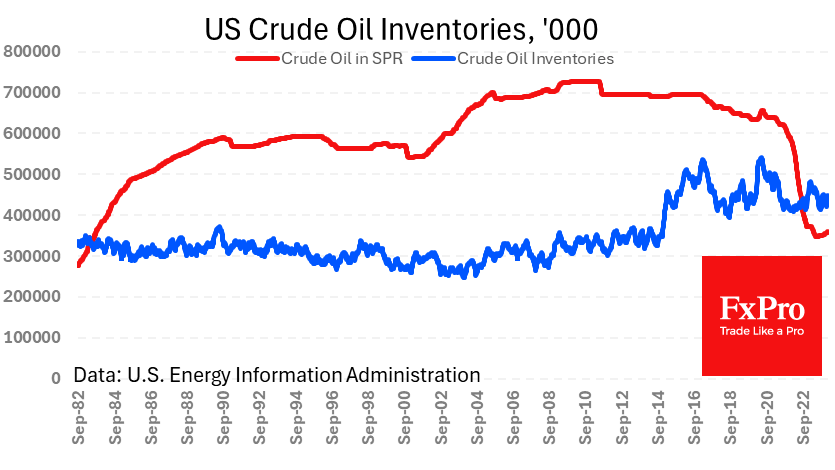

America continues to build up its oil reserves, albeit at a relatively slow pace and from a low base. Last week, commercial oil inventories rose by 4.2 million barrels. About ¾ million barrels were added to the Strategic Petroleum Reserve, a pace the government has been pursuing since mid-December.

At this rate, it would take more than seven years of replenishment to bring the reserves back to their April 2021 plateau. Admittedly, this is unlikely to happen at all, as America has become a net exporter and needs these reserves less than it did at the end of the last century.

In the short term, the increase in reserves has been a deterrent for oil prices in recent weeks. Yesterday, the price of WTI failed to break away from its 200-day moving average.

However, the report of rising inventories acted as a catalyst, while the main reason was comments from an influential energy advisor from Russia. Mr Novak, who previously played a crucial role in coordinating OPEC+ efforts, said that extending production cuts into the second quarter was not yet a done deal.

The net result of these swings is that oil has been stuck at the 200-day average for the past two weeks. This has also been the area of resistance since the second half of November: all this time, WTI oil has been held by the bears as they approach $80.

A defence of this level looks fundamental, as it could inspire speculators to step up their buying, breaking away from the 200-day and turning it to the upside. The current 3% sideways range in oil is very narrow, so we expect a trend to start soon in either direction.

But we should not forget that oil has been stuck in the 5-8% range for several months in recent years.

The FxPro Analyst Team