A strong labour market will force the Fed to increase tightening

April 01, 2022 @ 16:57 +03:00

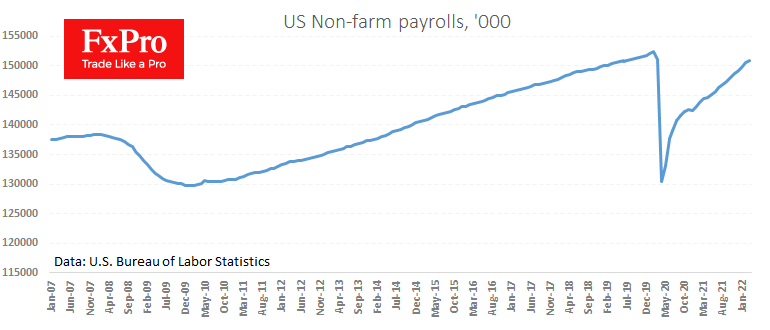

In March, the US economy created 431K new jobs, less than the expected 500K. However, a substantial upward revision of the February data (750K instead of the initially reported 678K) shows that the labour market is still recovering ahead of schedule, which is good news for the Dollar as it unleashes the hands of tighter monetary authority rhetoric.

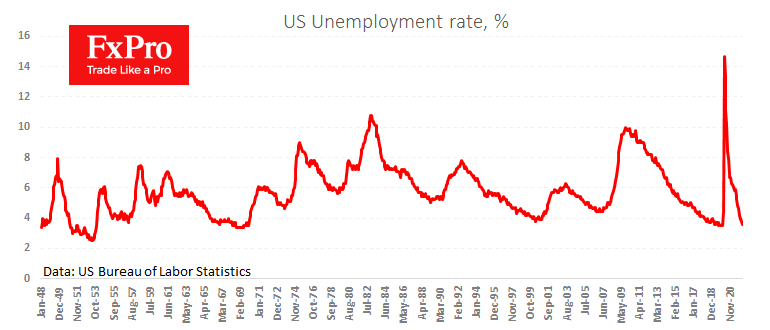

There are also several additional positives. The unemployment rate has fallen from 3.8% to 3.6%, one tick away from the 2020 low. Such a low figure was briefly recorded as long as in 1969, consistent with the weekly jobless claims data signals. Wage growth accelerated to 5.6% in the previous March, faster than the 5.2% (revised from 5.1%) a month earlier.

While there was not a solid initial reaction in the markets to this report, it should be seen as positive for the Dollar as it demonstrates the labour market’s strength. The combination of historically low unemployment, accelerated hiring, and higher wage rates are adding to the USA’s inflationary pressure.

In the current environment, the chances are increasing that the Fed will announce active asset sales from the balance sheet on the 05th of May meeting or raise the rate by 50 points at once. So far, we are more inclined towards the first option to not create problems for the US treasury at the longer-term end of the curve.

The FxPro Analyst Team