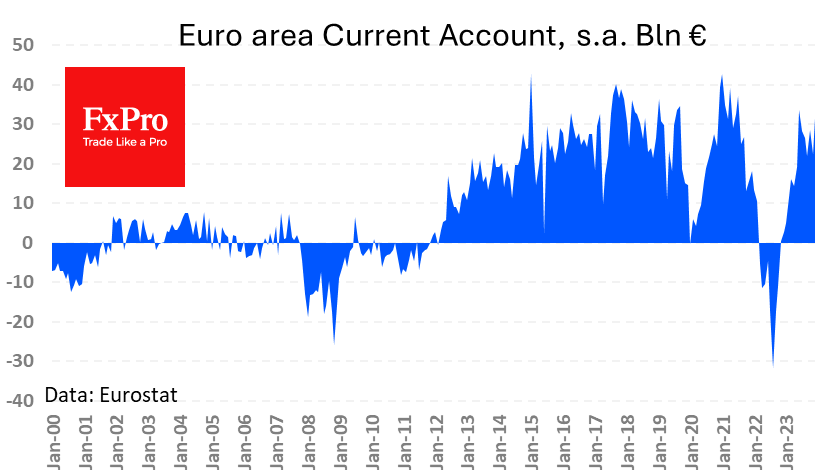

The eurozone’s current account surplus climbed to a six-month high of 31.9bn in December. Analysts, on average, had expected a decline to 20.3 bn from 22.5 bn the previous month. The current level was seen in the eurozone during the relatively benign pre-Covid period and sometime before Natural Gas prices spiked in the second half of 2021.

The normalisation of the surplus is good news for the single currency, as it means more net capital inflows into the region. But this growth has been fuelled by falling imports, which can be the result of lower commodity and energy prices (which is a very good thing), but also partly indicative of a slowdown in domestic demand. This threatens to translate into economic contraction in the coming months.

The euro area experienced periods of severe import contraction in late 2008 and early 2010, and in both cases, the economy experienced a severe downturn. Back in 2008, all this was accompanied by the collapse of the euro.

The FxPro Analyst Team