A stable lira rate probably helped Turkey to near inflation peak

April 29, 2022 @ 15:24 +03:00

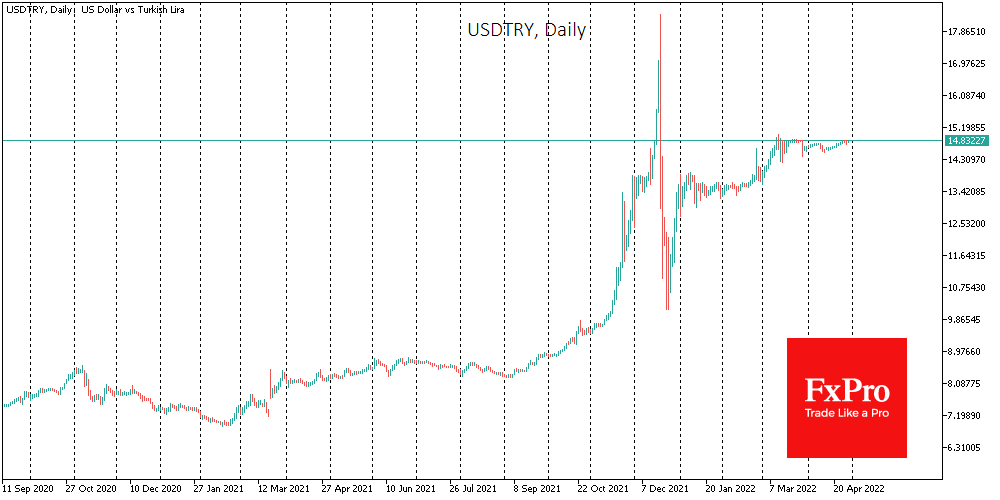

The Turkish lira rose 3.3% against the euro in April due to the latter’s weakness. However, a monthly close near 14.82 for USDTRY would be another all-time high, as the lira has little to counter the strengthening dollar.

The remarkable stability of the lira after the wild swings of the past year works in favour of macroeconomic stability, but this is not enough, considering the shaken economic fundamentals of the past seven months.

Producer prices have doubled over the year, and consumer inflation exceeded 61% YoY in March. Turkey is vitally dependent on energy imports but soaring energy prices only partly explain the inflationary Armageddon in Turkey. The strongest and perhaps the most significant contributor to the final price increase is the twofold increase of the dollar against the Turkish lira in the 12 months to March.

The stabilisation of the lira in recent months neutralises the effect of exchange rate movements on inflation. Furthermore, we see a stabilisation of prices for Turkey’s main import items. Gas and wheat prices are high by historical standards, but they are not renewing records positively, meaning their positive contribution to inflation is slowly offsetting.

Inflation likely passed its peak in March, and new April data to be released in the coming days will show a trend reversal.

The FxPro Analyst Team