A sharp EUR & JPY rise calls for caution with risk-on

April 09, 2021 @ 10:15 +03:00

The dollar has been under pressure, having retreated 1.3% against a basket of six major currencies due to increased buying in debt markets and unexpectedly strong data from Europe.

However, recent moves in the currency market still speak more to increasing buyer wariness rather than optimism. Safe-heaven currencies often serve as an early signal of market caution. And since the start of April, we have been getting that signal.

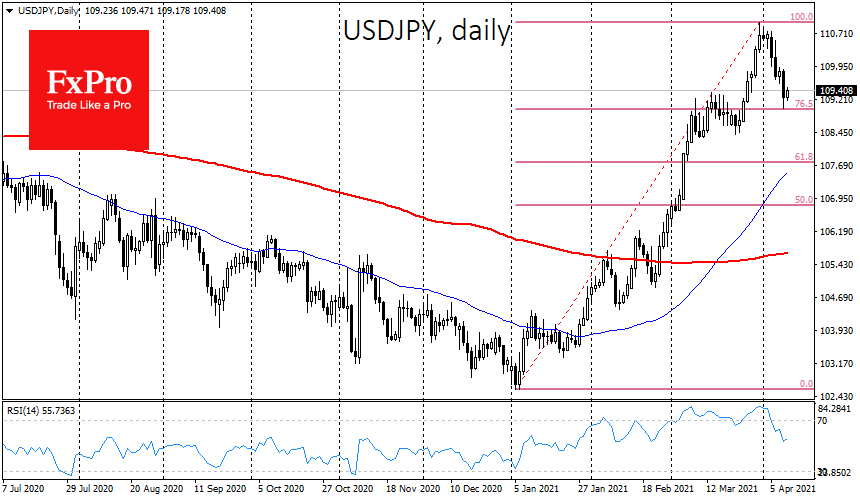

The Japanese yen, which had been actively losing since the beginning of the year, this week grew sharply, the most since September, sending USDJPY from the 111 area in late March down to 109 yesterday. It is too early to say that we are on the verge of a broader market sell-off as the current pullback so far remains within the correction pattern of the previous rally. A further decline under 109 could spread profit taking sentiment to other markets and currencies.

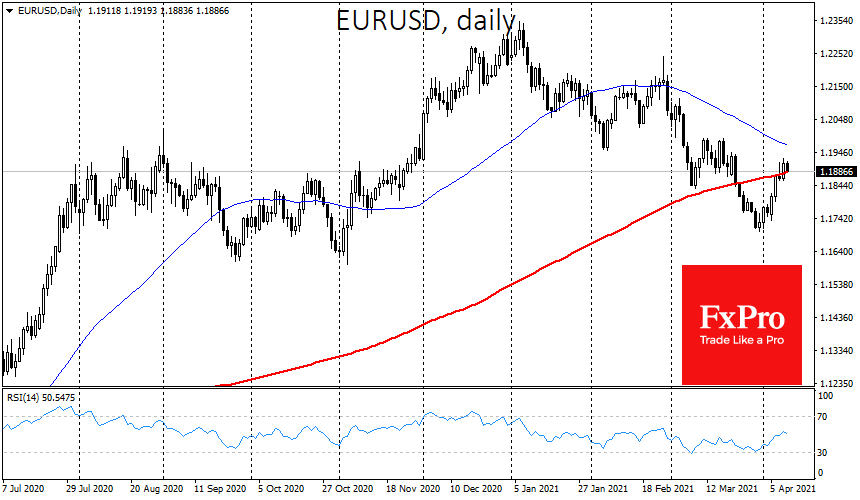

The recovery of EURUSD should also be seen as a signal of increased defensive demand. The European Central Bank ramped up asset purchases on the balance sheet, thereby increasing short-term pressure on the Euro.

However, this didn’t stop the Euro as it gained momentum, taking EURUSD above the 200-day average and the 1.1900 level. Here too, we saw the sharpest gains since the end of last year in the outgoing week.

On the other hand, the risk-sensitive British pound has decisively retreated against the dollar since Tuesday, losing 1.4% in that time and falling to 1.3700. Naturally, in pairs vs Euro and Yen, the pound has the most radical reversal from the recent extremes.

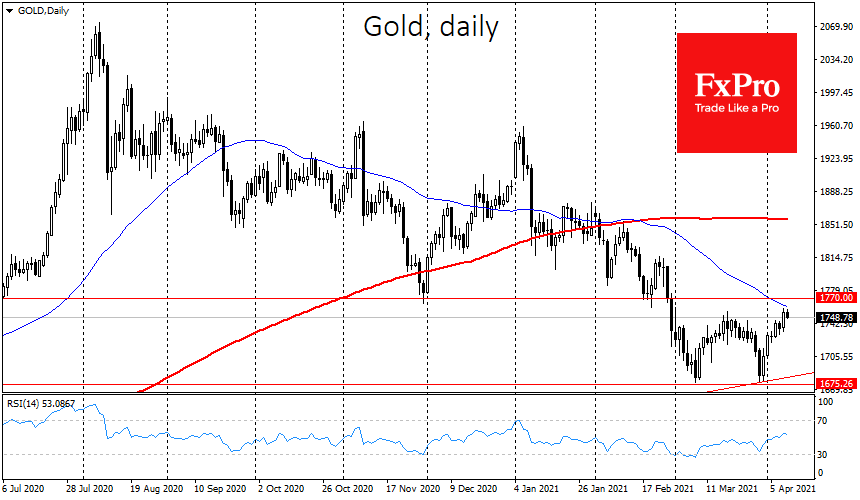

Interestingly, gold is enjoying demand in this environment, recovering to $1755, the highs since early March. The price has now retreated to $1750, encountering resistance in the form of the 50-day moving average. As in the currency market, the beginning of April is marked by moves against the trends that have prevailed so far this year. Traders and investors should pay attention to this market reversal.

It could be a short-term rebalancing of portfolios in the new quarter or the start of a new market micro-cycle. In the former case, we could see a recovery in the dollar and pressure on the Euro and yen sometime next week. In the latter case, the pull of defensive assets will gain momentum, causing a decline in equity and commodity prices but helping gold in the short term.

The FxPro Analyst Team