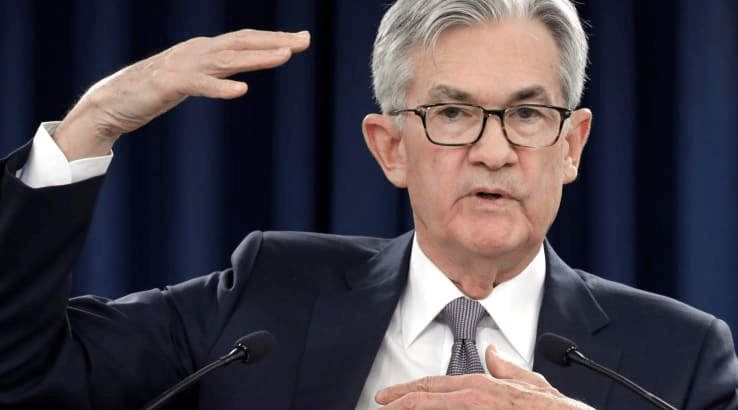

Even before Covid-19 crushed the economy, the Fed was worried about low inflation and was working on ways to let it run slightly hotter temporarily in order avoid the trap of long-term sluggish growth and weak pricing power. Chairman Jerome Powell, in a much-anticipated speech Thursday, is expected to discuss the Fed’s policy framework and specifically how it will alter its posture on inflation. The Fed has had a 2% inflation target, but in the decade since the financial crisis it has more often than not seen inflation fall below its target.

The way the Fed is expected to meet its goal is to say it will have an “average inflation” target, and Fed watchers said officials may provide a band for tolerable inflation levels above and below its current target of 2%. The Fed is expected to make that announcement at its September meeting, and Powell’s 9:10 a.m. ET comments at the annual Jackson Hole symposium Thursday could be a preview.

Treasury yields have been rising ahead of the Fed’s symposium, which will be held virtually this year instead of in the shadows of the Grand Tetons. The closely watched event has sometimes been used to foreshadow policy moves, and Fed watchers expect Powell to preview what should be a significant change in guidance on policy.

The Fed has taken extraordinary actions to fight the impact of the coronavirus. It has vowed to keep rates at zero for a long time; it also has provided more liquidity, purchased assets and inserted itself in different markets to assure they run smoothly.

The Fed already had been reviewing its policy framework, and inflation was part of it. Even before the virus, Fed officials had said they would allow inflation to overshoot their 2% target but they didn’t formalize it.

In the 12 months through June, the core PCE price index increased 0.9% after rising 1.0% in May. The core PCE index is the preferred inflation measure for the Federal Reserve’s 2% target.

Fed watchers said Powell may acknowledge that the traditional path of inflation has changed. Powell’s speech is about the Fed’s policy framework and navigating the next decade.

The Fed is expected to use a new pandemic-era tool to fight a long-running battle against low inflation, CNBC, Aug 27