A Global Consumer Default Wave Is Just Getting Started

March 30, 2020 @ 17:35 +03:00

The early indicators from China aren’t pretty. Overdue credit-card debt swelled last month by about 50% from a year earlier, according to executives at two banks who asked not to be named discussing internal figures. Qudian Inc., a Beijing-based online lender, said its delinquency ratio jumped to 20% in February from 13% at the end of last year. China Merchants Bank Co., one of the country’s biggest providers of consumer credit, said this month that it “pressed the pause button” on its credit-card business after a “significant” increase in past-due loans. An estimated 8 million people in China lost their jobs in February.

“These issues in China are a preview of what we should expect throughout the world,” said Martin Chorzempa, a research fellow at the Peterson Institute for International Economics in Washington. While the extent of the squeeze on consumers and their lenders will depend on the effectiveness of government efforts to contain the virus and shore up economies, the scope for pain is immense.

Households around the world now have $12 trillion more debt than they did during the run-up to the 2008 financial crisis, the Institute of International Finance said in a report this month. Household debt-to-GDP ratios in countries including France, Switzerland, New Zealand and Nigeria have never been higher.

In Australia, which has the highest household debt levels among G20 nations, the country’s largest lender said on Thursday that its financial assistance lines are receiving eight times the normal call volume. A similar surge in queries has flooded lenders in the U.S., where credit-card balances swelled to an unprecedented $930 billion last year and 3.28 million people filed for jobless benefits during the week ended March 21 — quadruple the previous record.

With corporate delinquencies rising as well, Chinese banks could face a 5.2 trillion yuan surge in total nonperforming loans and an unprecedented 39% slump in profits this year, according to a worst-case scenario outlined by UBS Group AG analysts this month.

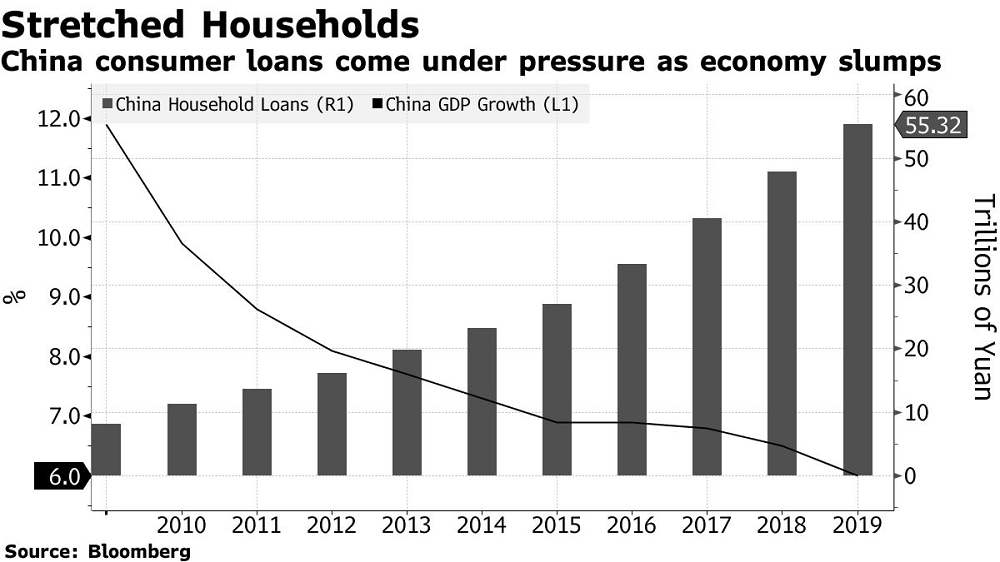

Yet stimulus is unlikely to tide over everyone, particularly in places like China where household finances are stretched like never before. The country’s consumer debt-to-income ratio surged to 92% at the end of 2018 from 30% a decade ago, surpassing Germany and closing in on levels in the U.S. and Japan, according to IIF. The risk is that a prolonged economic slump and weak real estate market will force more people to renege on their loans.

A Global Consumer Default Wave Is Just Getting Started, Bloomberg, Mar 30