Current situation

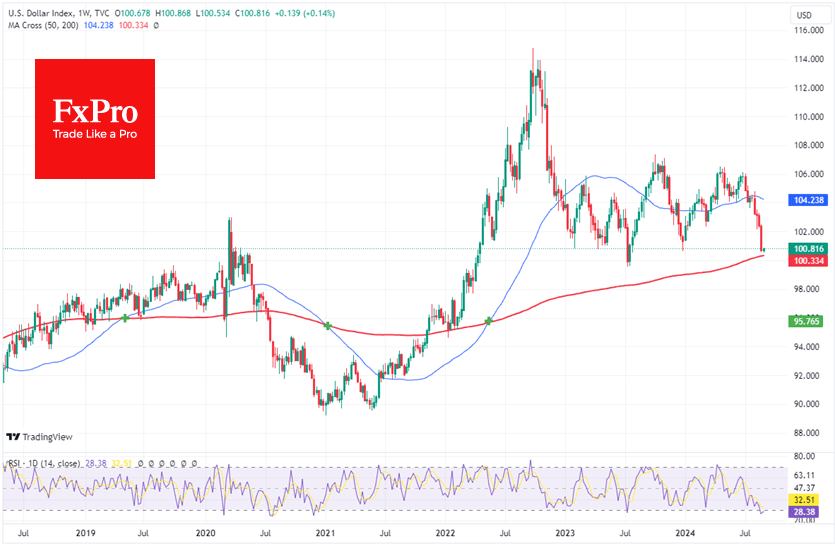

The Dollar Index closed last week at 100.55, its lowest level since July 2023. It has not been consistently below this level since April 2022.

Technical analysis

Although the change of monetary regime in the US is of fundamental importance, the bulls may launch a counterattack in the short term. On a weekly basis, the Dollar’s RSI has moved back into oversold territory, which was last seen 13 months ago, marking a turning point. In 2020, the entry into oversold territory did not lead to an immediate reversal, but the downside momentum was largely exhausted.

Just as importantly, this exhaustion occurred on the move towards the key 200-week moving average, the approach of which in early 2022 revived dollar buying momentum.

Fundamental analysis

From a fundamental perspective, the currency market has unnecessarily sold off the dollar. Interest rate futures are now realistically pricing in a 25-point (66%) rate cut in September, in stark contrast to the 50-point confidence in a cut recorded on 5 August.

By moving expectations towards a normal (25-point) hike, the Fed will sound more hawkish than the market has priced in, favouring a dollar rally in the coming weeks.

Forecast

The only way a potential short-term dollar bounce has a chance of becoming a rally is if there are negative shocks to financial markets. In the absence of such shocks, the dollar’s recovery may stall in the 101.7-102.5 area.

The FxPro Analyst Team