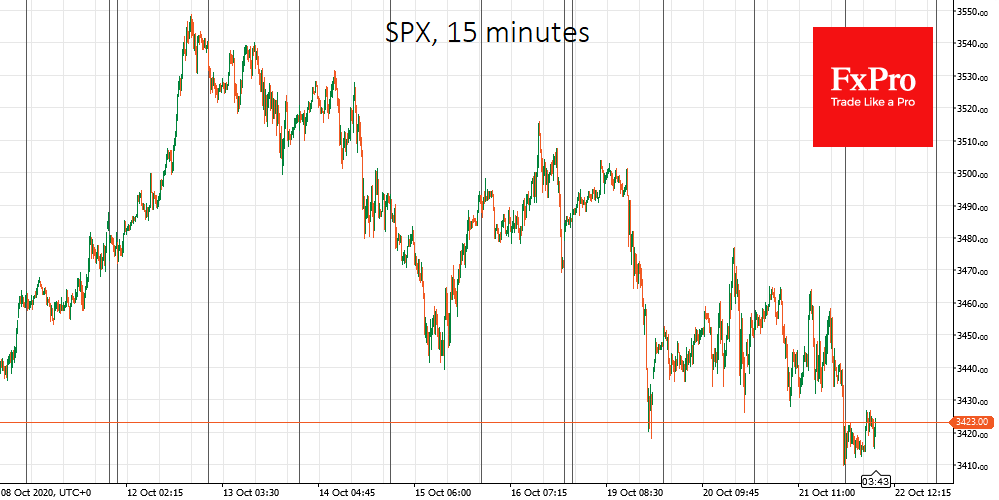

Simultaneous pressure on the dollar and risk assets in the markets is continuing. Futures on S&P500 lost 3.7% from recent highs on October 12th. The dollar index fell to its lowest level since September 2nd, almost completely recouping the correction rollback of the previous month.

Previously, we saw increased demand for the renminbi, which was rising to more than 2-year highs after the 7% rally. Yesterday, the British pound and the yen were the main market movers in pairs with the dollar. The pound jumped more than 1.5% on Wednesday alone on reports of continued Brexit negotiations after Johnson’s deadline.

There were no significant drivers for the yen. Very often its declines go hand in hand with or precede downward impulses for stocks. The pair fell to local lows near 104.5, where it has reversed towards growth in the last four years.

The movement of the Japanese yen against the dollar is so strongly linked to the market sentiment that its weakening may become a self-fulfilling prophecy. It is, therefore, worth keeping a close eye on the development of USDJPY dynamics until the end of the week. A rapid rebound will help to shake off fears and set the mood for further optimism recovery in the markets. If USDJPY continues its decline, the stock market may follow.

As we look at the daily dynamics of the US indices, it should be noted that the decline intensifies before the main trading session closes, indicating sales by institutional investors.

The weakness of the US stock market and the weakening of the dollar may prove to be a temporary investment hint associated with election uncertainty. In this case, investors will await the results of the election: either a clear leadership by one of the candidates or an actual victory.

So far, there is little reason to think a Trump or Biden victory will result in a decisive failure of the dollar or a rise in the markets. Whoever wins will be dealing with the same problems in the economy, including the huge public debt and the need to increase it as the coronavirus pandemic intensifies. On the other hand, current monetary conditions are incredibly mild, and the markets remain reasonably liquid. This means investor money can continue to be held in risky assets, maintaining indices.

The FxPro Analyst Team