The reasons why Bitcoin just dropped after failing to break $19.5K again

December 15, 2020 @ 10:00 +03:00

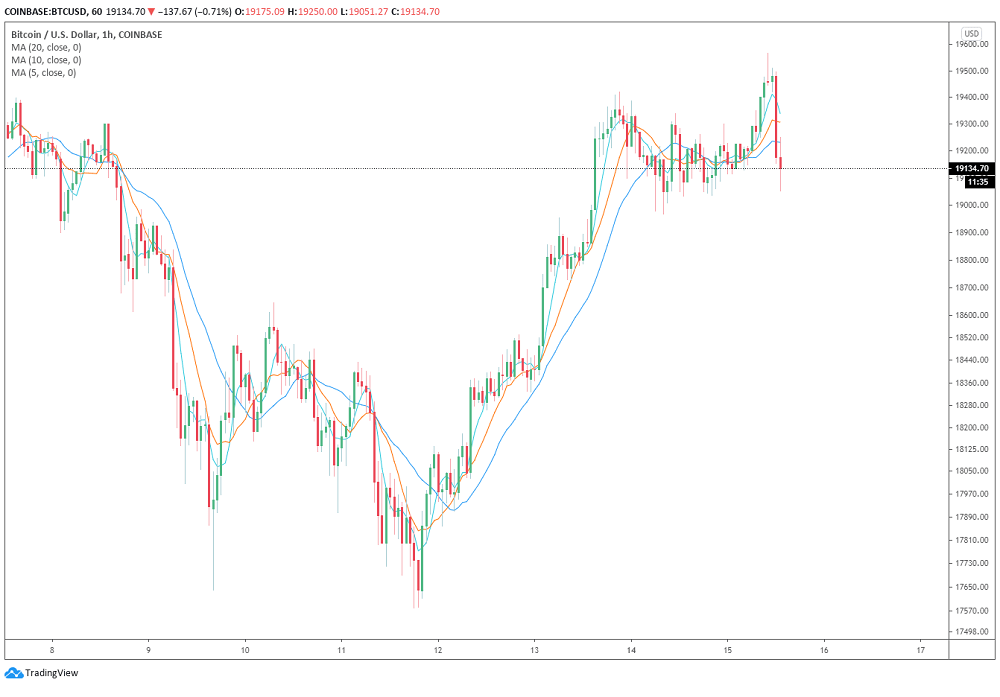

The Bitcoin price (BTC) surged above $19,500 briefly on Dec. 15, reaching as high as$19,570 on Binance. However, BTC then dropped to $19,050 within three hours, recording a sudden 2.5% pullback. Bitcoin spiked to around $19,600 because of the momentum of its relief rally and negative futures market funding rates. But, it rejected the same level it broke down from since November due to the selling pressure from whales.

As Cointelegraph reported on Dec. 12, technical indicators showed BTC was oversold after Bitcoin dropped below $17,600. The 4-hour candle chart saw a bullish divergence and a TD9 buy indicator, signaling that selling pressure was exhausted.

Bitcoin price quickly recovered above $18,000 and continued its run past $18,300. BTC then breaking the whale cluster key resistance level at $18,800 further boosted its momentum. Buoyed by the relief rally, Bitcoin continued to soar, eventually surging to as high as $19,570 across major exchanges.

The futures funding rates across Binance Futures and other major platforms turned negative as Bitcoin began to recover above $18,000. The funding rate of Bitcoin futures contracts turns negative when there are more short-sellers than buyers. This means the likelihood of a short squeeze increases, which could cause buyer demand to suddenly spike. Although the funding rate was negative for a brief time since Bitcoin’s funding rate rarely turns negative, it was indicative of aggressive selling.

A pseudonymous trader known as “Byzantine General” pointed out that short-sellers were highly aggressive throughout the relief rally. A move above $19,300 would squeeze many shorts, he added, saying: “Shorts were really aggressive again and they’re underwater now. Breach through 19300 and they get squeezed hard.”

As soon as Bitcoin surpassed $19,300, it quickly made its way to $19,570, suggesting that a large short squeeze occurred.

3 reasons why Bitcoin just dropped after failing to break $19.5K again, Cointelegraph, Dec 15