World stocks set for worst week since 2008 financial crisis

March 13, 2020 @ 13:22 +03:00

World stocks were set on Friday for their worst week since the 2008 financial crisis, with coronavirus panic-selling hitting nearly every asset class and investors fretting that central bank action may not be enough to soothe the pain. European stock markets were slightly higher on Friday on hopes governments will step up spending, but only after several sessions of sustained, heavy losses as investors faced the possibility of a global recession that could be prolonged.

Warning signs still flashed, with Italian government bonds tanking again on Friday morning, after suffering their worst day in nine years in the previous session. Italy and Spain meanwhile imposed trading curbs, banning short-selling of dozens of stocks, to stem a market rout triggered by the coronavirus outbreak that saw European stock exchanges post their worst-ever losses on Thursday.

The MSCI world equity index, which tracks shares in 49 countries, hit a three-year low in Asian hours and is down 16% this week so far — its worst run since October 2008 when Lehman Brothers’ collapse triggered the global crisis. MSCI’s main European Index was up 2.7% at the open, after having fallen more than 20% over the past week.

Earlier, Japan’s Nikkei fell 10% before paring losses to close 6% lower. Australia’s S&P/ASX200 had its wildest trading day on record, falling past 8% before surging in the last minutes of trade to settle 4.4% higher at the close. MSCI’s broadest index of Asia-Pacific shares outside Japan wobbled 0.1% higher by late afternoon after falling more than 5% in morning trade. The slight recovery came as central banks from the United States to Australia pumped liquidity into their financial systems and as hopes grew that U.S. Democrats and Republicans could pass a stimulus package on Friday.

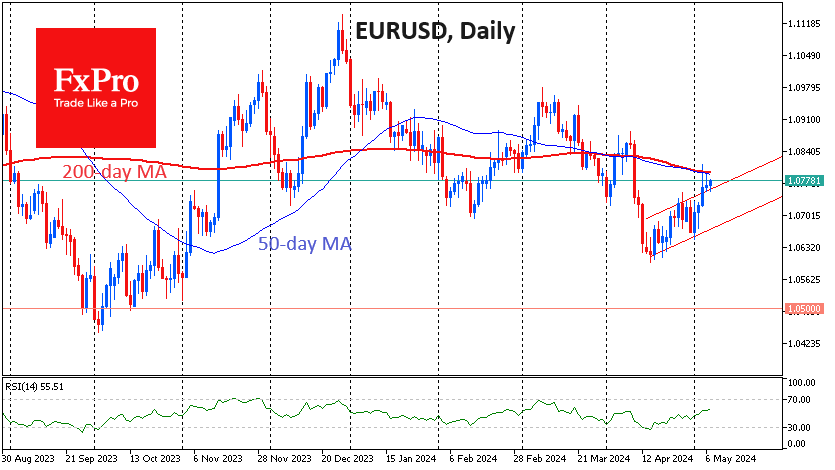

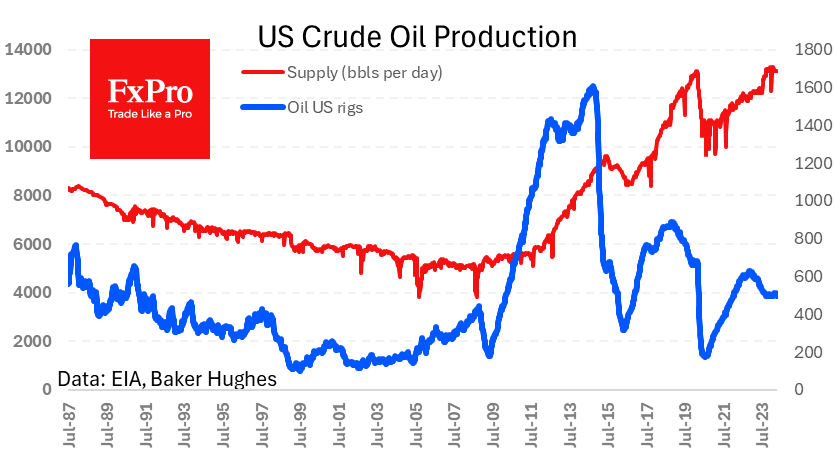

Italy is one of the worst-hit countries in Europe from the spread of coronavirus, with the death toll shooting past 1,000 people and the government ordering blanket closures of restaurants, bars and almost all shops. Oil steadied on Friday, after having dropped 7% on Thursday on U.S. President Donald Trump’s surprise travel ban and on a flood of cheap supply coming into the market from Saudi Arabia and the United Arab Emirates. Major currencies stabilised after furious dollar buying overnight, with the euro finding a footing around $1.1200 and the Aussie recovering to $0.6300.

World stocks set for worst week since 2008 financial crisis, Reuters, Mar 13