Why this week’s Fed meeting could be ‘March madness’ for markets

March 16, 2021 @ 11:23 +03:00

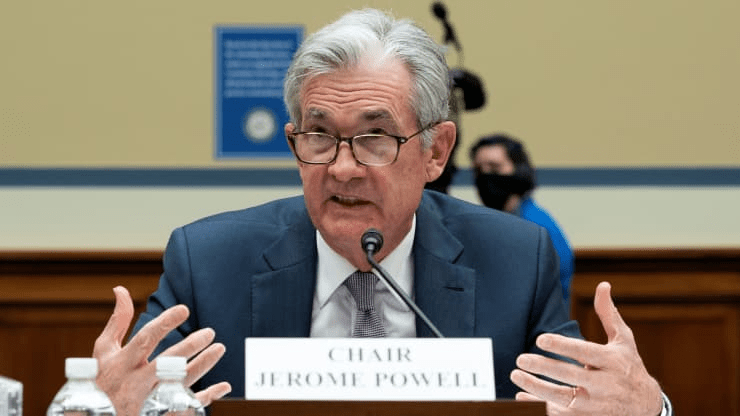

Odds are high the Fed will move markets this week, no matter how hard it tries not to. With the surge in interest rates and rebounding economy, the Fed’s easy policies are in the spotlight, and increasingly the question has become when will it consider unwinding them. Fed Chairman Jerome Powell is likely to be asked questions about the Fed’s low interest rate policies and asset purchases during his press briefing, following the Fed’s two-day meeting that concludes Wednesday.

Powell is unlikey to be specific but what he says could rock the already volatile bond market, and that in turn could drive stocks. It could particularly hit growth stocks, if bond yields begin to rise. Powell clearly has the ball, and what he decides to say Wednesday will dictate to edgy markets how soon the Fed might consider paring back its bond buying and even raising interest rates from zero.

The Federal Open Market Committee will release its statement at 2 p.m. ET Wednesday, after the meeting, and Fed watchers expect little change in the text. But the Fed also releases officials’ latest forecasts for the economy and interest rates. That could show that most officials would be ready to raise the fed funds target rate range from zero in 2023, and a few members may even be ready to raise rates next year.

The Fed meets against a back drop of rate volatility in the more typically staid Treasury market. Over the past six weeks, the 10-year yield, which influences mortgage rates and other loans, has risen from 1.07% to a high of 1.64% last Friday. It was at 1.6% Monday. The yield, which moves opposite price, has been reacting to a more upbeat view of the economy, based on the vaccine rollout and Washington’s stimulus spending. It has also reacted to the idea that inflation could pick up as the economy roars back. Powell has said the Fed expects to see just a temporary jump in inflation measures in the spring because of the depressed prices during the economic shutdown last year.

In the last forecast, five of 17 members expected a rate hike in 2023, and just one forecast a hike in 2022. Fed officials provide their rate forecasts anonymously, on a so-called dot plot. The Fed has said it would continue its bond purchases until it’s made “substantial progress” towards its goals.

Why this week’s Fed meeting could be ‘March madness’ for markets, CNBC, Mar 16