What’s next from the Fed will help decide the course for markets

June 10, 2020 @ 08:51 +03:00

The Fed has gotten high marks for moving aggressively to unlock credit markets and keep money moving in an unprecedented crisis. What’s next is now the challenge.

How much the Fed will reveal about its future intentions and what it says about its view of the economy could be the keys to this week’s two-day meeting, and bond market strategists say a number of outcomes could be market moving.

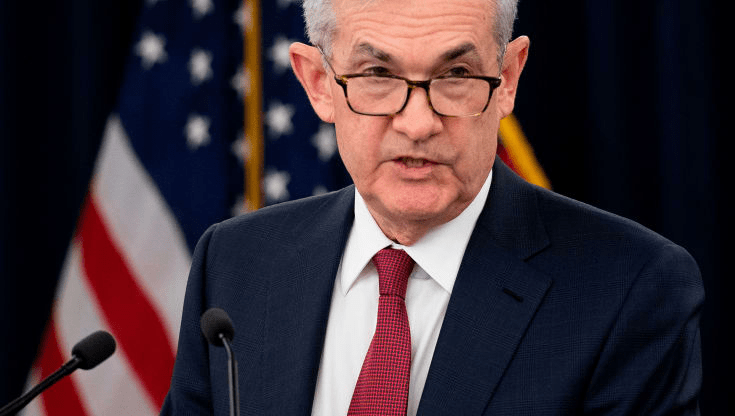

The Fed is not expected to take any action on rates or policy at its meeting, which ends with a statement Wednesday afternoon and is followed by a briefing by Chairman Jerome Powell.

Powell has already taken more actions and at a faster pace than any chairman before him. The Fed has slashed benchmark interest rates to near zero and announced numerous programs to help different parts of the markets and economy.

They include programs to provide lending programs and support municipal bonds, mortgages, commercial paper and corporate bonds. The corporate bond facilities have barely launched but have helped ease conditions so much that companies tapped about $800 billion in the investment grade market since the Fed announced the programs in late March, a confidence booster for the stock market.

When the Fed issues its statement Wednesday, it is expected to release its quarterly economic and interest rate forecasts, which it declined to do at the height of the crisis in March. Now, the Fed has a chance to describe what it thinks the future path might look like, provide forecasts and possibly add clarity about its programs and future steps.

″“I think the Fed will keep leaning on the side of being accommodative. In no way will it signal an end to that and in no way will it signal reluctance to be an implicit partner with the U.S. Treasury in supporting the proper and full functioning of various markets, including the Treasury market,” said Tony Crescenzi, vice president and member of Pimco’s investment committee.

The Fed is not likely to give too much detail on its future plans, because forecasting the path of the economy is so uncertain given its rapid collapse. Economists expect to see a contraction of more than 30% for the second quarter, but they vary on how much and if the third quarter bounces back.

But some believe the Fed’s comments, no matter how carefully crafted, could impact markets. The stock market bottomed March 23, as the Fed announced a battery of new programs, and the S&P 500 is now up more than 47% since then. The Treasury market, until last week, stayed in a ultra-low range with the 10-year yield below 0.75%. As jobs data improved, the 10-year yield, which moves opposite price, jumped to 0.95% last week before backing down. It was 0.82% Tuesday.

There has been speculation that the Fed could announce a program at some point to control the yield curve and prevent interest rates from rising too much, as the economy starts to improve.

What’s next from the Fed will help decide the course for markets, CNBC, Jun 10