US Macro: Alarming sign from Initial jobless claims

March 14, 2019 @ 17:28 +03:00

A fresh bulk of the U.S. data is quite alarming, although it is unlikely to be a reason for the market’s sale-off

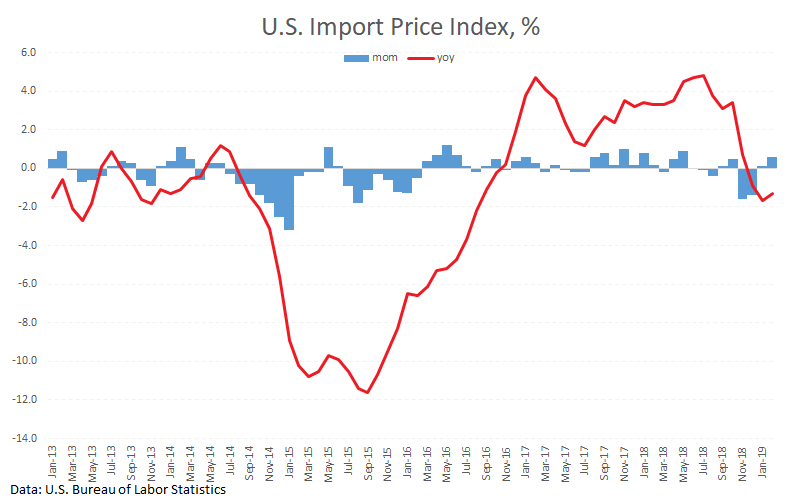

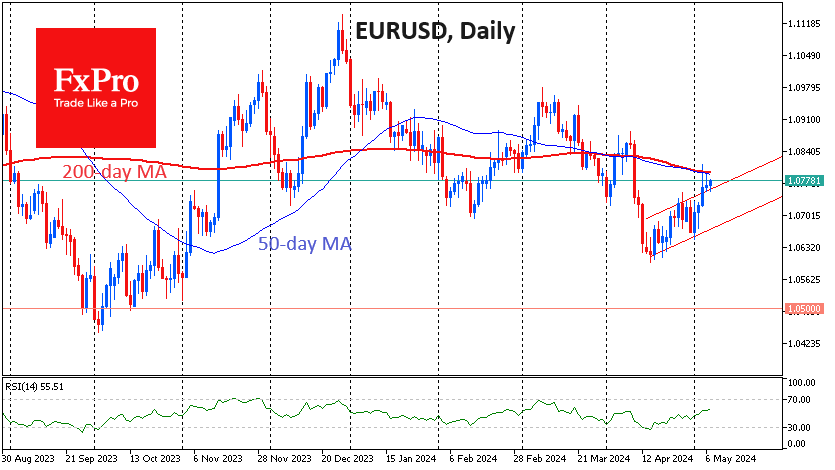

Import prices rose by 0.6% in February, twice as much as the expected growth by 0.3%. The year to year decline eased from -1.6% to -1.3%, vs expected -1.6%. On the contrary with the previous CPI and PPI data, that was softer than expected, this advanced inflationary indicator suggests that in the coming months the space for softening the Fed’s rhetoric may shrink. It’s good for the dollar and not good for stock markets.

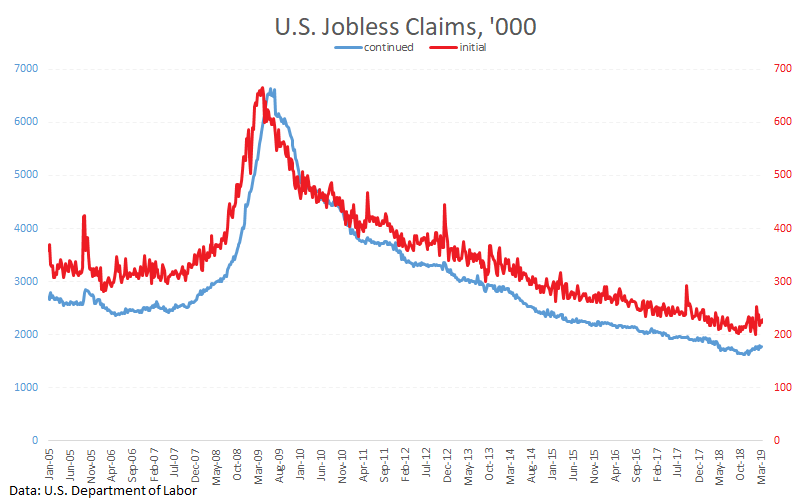

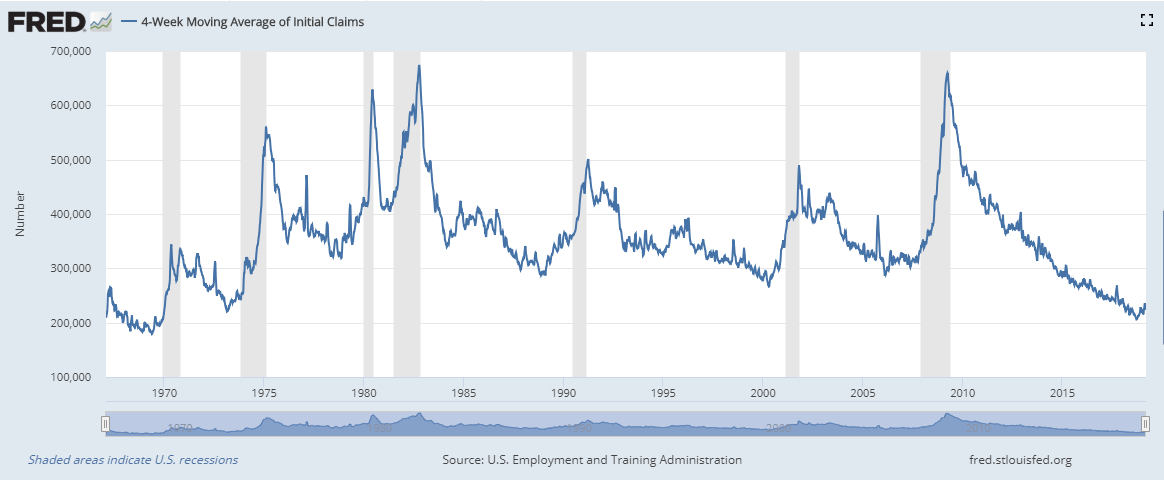

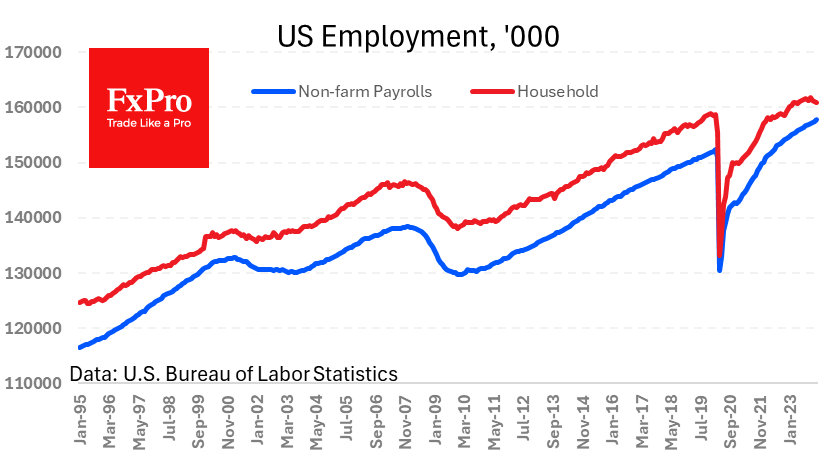

Initial jobless claims data came out worse than expected. Last week it grew from 223K to 229. Continued claims stood at 1776K against 1758K one week earlier. These indicators clearly maintain their growth trend. There is some fear of claims growth in the markets, as the United States has previously plunged into recession and markets have lost their ground even earlier.

Alexander Kuptsikevich, the FxPro analyst