Turkish Lira Drops as Rate Policy Takes Priority Over U.S. Vote

November 04, 2020 @ 19:18 +03:00

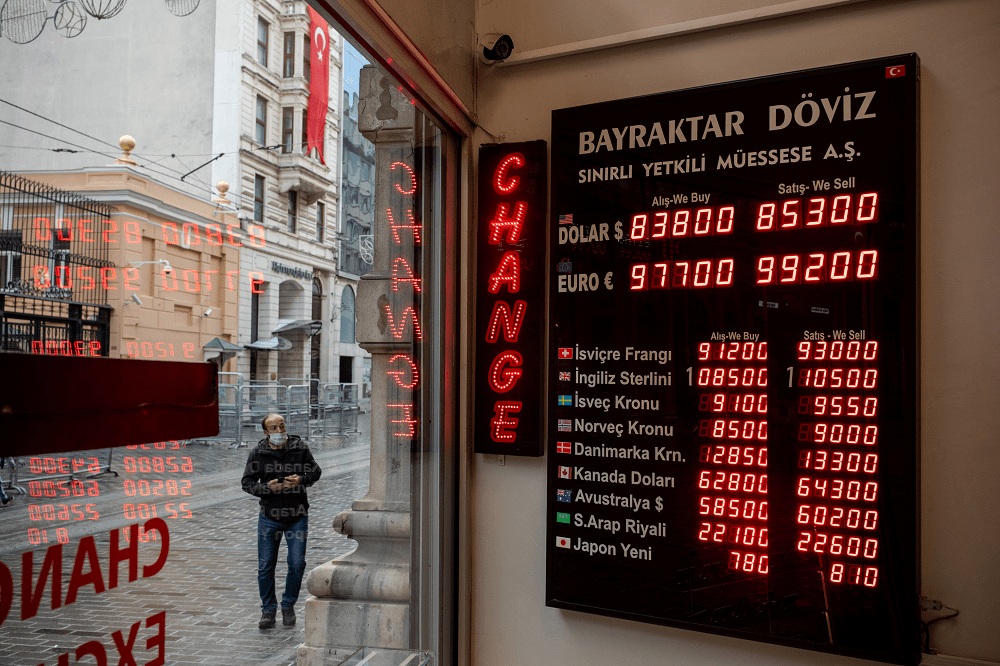

The Turkish lira resumed its drop as early presidential election results in the U.S. pointed to a closer race than polls had predicted, while traders focused on the prospects for a local interest-rate hike.

The lira fell as much as 1.5% to 8.5253 per dollar, its ninth loss in 10 days, before paring the slide to 0.6% as of 4:52 p.m. in Istanbul. That bucked a rebound among emerging market peers and offset the gains of the previous day, when speculation about a possible interest-rate increase lifted the Turkish currency.

While investors have argued that a win for Donald Trump would help the lira by easing the chance of sanctions against Ankara, the currency was still among the worst performers in emerging markets on Wednesday, even with the incumbent still firmly in the race. Traders are more concerned about the direction of central bank policy, analysts said.

Investors have called for an emergency rate move after policy makers unexpectedly kept rates on hold last month. Measures to tighten liquidity and rates in the repo market without explicitly hiking the benchmark have failed to stem the lira’s decline as geopolitical pressures mounted.

A win for Trump, who has opposed Congressional sanctions against Turkey over the purchase of a Russian missile system, would be a relief for some Turkish assets. Democratic candidate Joe Biden has been critical of the Turkish government, and would probably take a tougher stance than Trump.

Turkish Lira Drops as Rate Policy Takes Priority Over U.S. Vote, Bloomberg, Nov 4