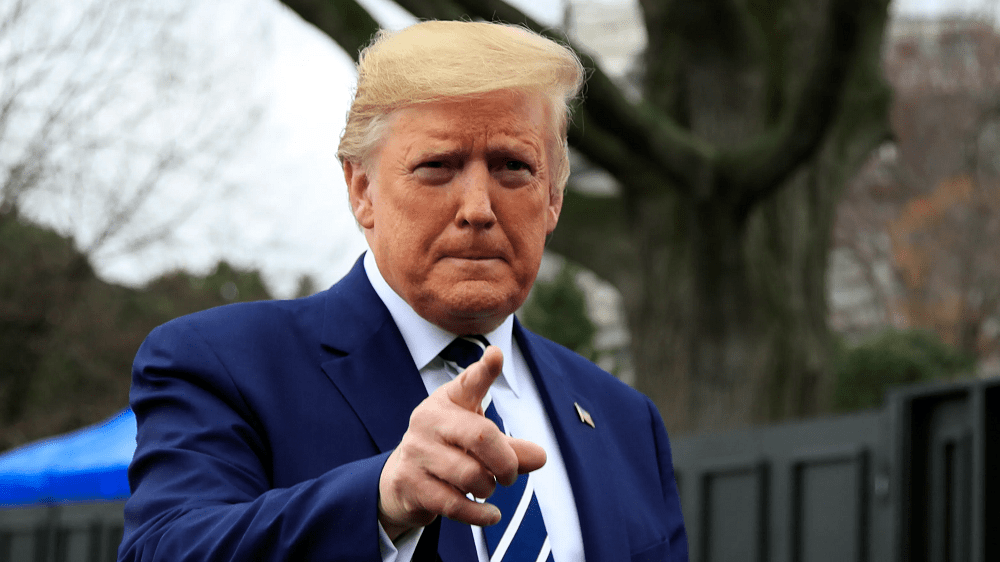

Tough-on-China stance is a key element of Trump re-election

May 21, 2020 @ 20:41 +03:00

U.S. fell as rising trade tension between America and China added to concern about the pace of recovery from the coronavirus pandemic. Crude oil fluctuated and the dollar strengthened.

The S&P 500 fell as much as 1.1%, with signs mounting that President Donald Trump will make his tough-on-China stance a key element of his re-election bid. Energy and consumer staples shares led the losses. After rallying as much as 32% from its March bottom, the index failed to hold at its average price over the past 100 days, a key technical level it hasn’t closed above since February. Trade tension with China contributed to market weakness in 2019 before a deal was reached.

Stocks hit the lows of the day after China responded to overnight accusations from Trump, warning that it will safeguard its sovereignty, security and interests, and threatened countermeasures. Earlier, a report showed another 2.44 million Americans claiming jobless benefits.

Markets were already on the back foot after the Senate overwhelmingly passed a bill that could bar some Chinese companies from listing on U.S. exchanges. Trump stoked tensions by tweeting criticism of Xi Jinping’s leadership, days before the biggest Chinese political gathering of the year.

The Stoxx Europe 600 Index fell, with nearly all 19 sector groups in the red. Deutsche Lufthansa AG shares bucked the trend after the carrier said it was close to a multibillion-euro bailout deal from the German government.

The S&P 500 Index decreased 0.7% to 2,956.02 as of 1:06 p.m. New York time.

The Dow Jones Industrial Average declined 0.4% to 24,523.05.

The Nasdaq Composite Index fell 0.7% to 9,324.71.

The Stoxx Europe 600 Index sank 0.7% to 340.26.

The MSCI All-Country World Index dipped 0.7% to 494.85.

U.S. Stocks Decline Amid China Tension, Jobs Data, Bloomberg, May 21