The Federal Reserve Cuts Wings of Banks

June 26, 2020 @ 12:07 +03:00

US markets managed to break out in plus at the end of trading on Thursday. The S & P500 added 1.1%, the Dow Jones rose 1.2%, and the Nasdaq managed to stay above 10,000, following an increase in banking sector stocks.

However, the Fed restrained the optimism of banks, announcing restrictions on the buybacks and dividends, as stress tests showed the vulnerability of the banking sector. On Friday morning, global markets play with a slight increase. Fed takes this step after critics that during the global financial crisis, banks received capital from the government, and then paid considerable bonuses to management.

As the test results showed, some banks are dangerously close to the minimum capital buffer requirements in the event of a worst-case scenario (unemployment at 19.5% and loan losses of up to $700B).

At the after-hours trading session, the shares of US banks lost 2-3% in response to the harsh rhetoric of the Fed. Perhaps it’s worth understanding that these steps are only the beginning of clarifications and strengthening supervision. The unprecedented Fed’s and US government stimulus certainly will lead to increased scrutiny.

Many companies have previously noted that SME support programs significantly limit company flexibility. In particular, recipients of these programs are prohibited from cutting staff until October.

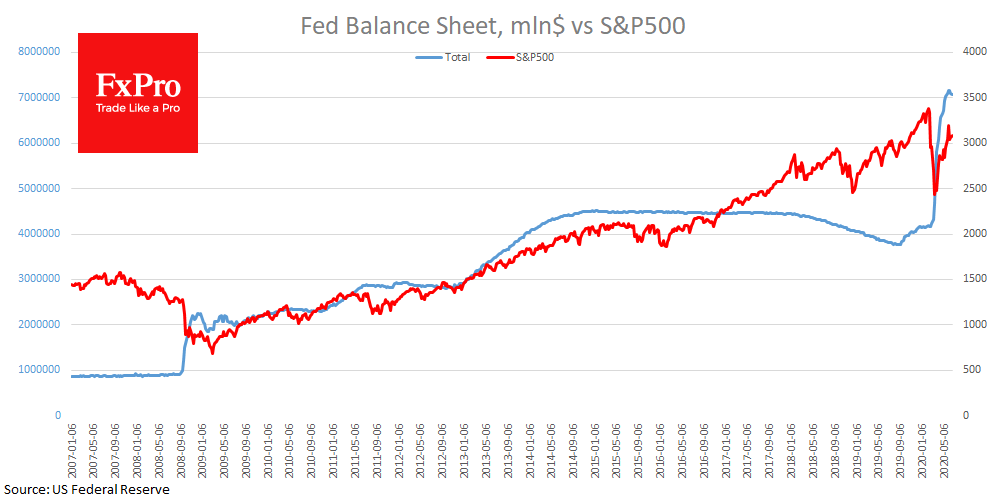

Apart from this, the Fed’s balance sheet continues to decline for the second week in a row. Its decrease is caused by a drop in demand for liquidity swap lines from other world Central Banks. However, combined, this develops into not such a positive picture.

Fed stress tests indicated the need for banks to increase protection against losses. The reduction in balance has a net negative, albeit small, effect on liquidity in the financial system.

Now banks will try to build up liquid capital by freeing up balances from risky assets. This turn may lead to pressure on the stock and commodity markets. The dollar and treasuries in these conditions could receive additional support.

Combined with a surge in new infections in the United States, this risks creating a turning point for investors from over-optimism to more mundane liquidity demand. It would be unnecessary speculation to talk about the risks of a new grand collapse in the markets. At the same time, more and more signs of slipping indices may appear.

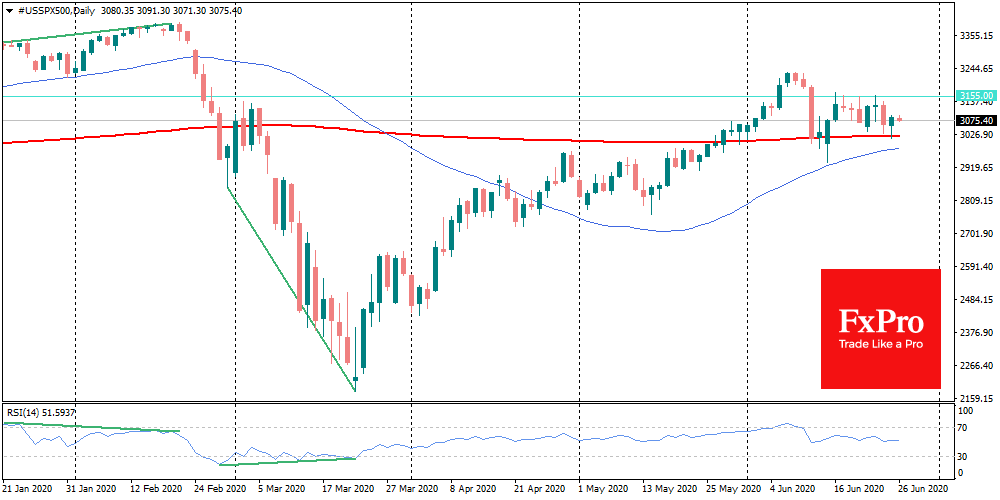

In June the S&P500 received support on dips to 200-DMA (now at 3023), but over the past ten days, it has not been able to cross the level 3155. Returning to the 200-day moving average or further, under the round level 3000, can increase pressure on stocks, at least for the following weeks.

The FxPro Analyst Team