The Dow Just Took a Dive – Even After the Fed Flashed a Bullish Signal

June 22, 2020 @ 17:25 +03:00

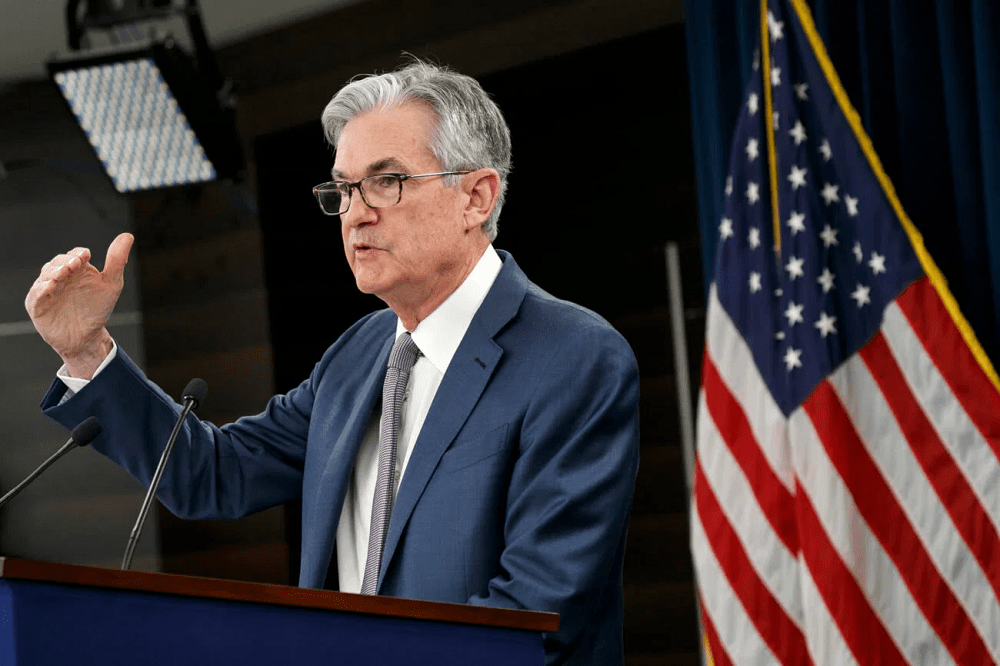

Stocks were flying during Monday’s premarket session, but when the opening bell rang, the Dow Jones Industrial Average (DJIA) quickly reversed course. Weakness set in even though traders have multiple reasons to feel bullish. The Federal Reserve hinted that the liquidity crisis that trigged the March selloff is now over. Chairman Powell rolled back the bank’s balance sheet by $74 billion – the most since 2009. And demand for dollar liquidity is at the lowest in months.

Simply put: the markets should be ready to stand on their own feet again. Analysts at Clifton Capital were cautiously optimistic about the move:

A drop in repos and central bank liquidity swaps has actually led to the first report of a decline in the Fed’s balance sheet in the latest report – this is a good thing, assuredly, but there’s a long way to go.

Dow futures had climbed more than 400 points from their lows overnight. At one point, the index looked set to open almost 1% higher.

But the Dow turned lower when the bell finally rang. As of 9:47 am ET, the DJIA had lost 125.73 points or 0.49% to dip to 25,745.73.

The S&P 500 and Nasdaq also turned slightly lower. The two indices dropped 0.42% and 0.14%, respectively.

By rolling back its balance sheet by the most since 2009, the Fed is sending a clear message: the worst of the liquidity crisis is over.

It was a dollar crunch that sent stocks into the fastest and sharpest bear market in history this March. Now the crisis has stabilized, so it’s one less fear for investors.

Not everyone is convinced the Fed’s actions are bullish. Many have pointed out the eerie correlation between stocks and the Fed’s balance sheet. As the Federal Reserve starts tapering off, there’s a real risk the S&P 500 and Dow Jones pull back with it.

The Dow Just Took a Dive – Even After the Fed Flashed a Bullish Signal, CCN, Jun 22