Stocks set for best month ever, dollar and gold pay the price

November 30, 2020 @ 17:10 +03:00

World shares paused on Monday to assess a record-breaking month as the prospect of a vaccine-driven economic recovery next year and yet more free money from central banks eclipsed immediate concerns about the coronavirus pandemic. Neither Europe or U.S. futures made further gains, but November’s record-breaking 13% leap has added $6.7 trillion – or $155 million a minute – to the value of world equities.

The rush to risk has also benefited oil, industrial commodities and given emerging-market currencies their best time in almost two years, while undermining the safe-haven dollar and gold. Helping sentiment further on Monday was a survey showing that factory activity in China beat forecasts in November, and the country’s central bank surprised with an extra helping of cheap loans.

Moderna provided the regular Monday dose of vaccine news, saying it was applying for emergency-use authorization from the U.S. Food and Drug Administration and conditional approval from the European Union. The positive developments on vaccines and swiftness with which they are likely to be rolled out have been key drivers.

Many European markets are boasting their best month ever, with France up 21% and Italy almost 26%. The MSCI measure of world stocks is up nearly 13%, while the S&P 500 has climbed 11% to record highs. Asia-Pacific shares outside Japan ended 1.5% lower on Monday but still finished the month almost 10% higher. The Nikkei’s 15% leap in Japan was its best month since 1994.

U.S. stock futures were fractionally lower before Wall Street’s open and crucial economic indicators later this week. Risk appetite was underscored, ratings and data agency S&P Global said it was buying IHS Markit for $44 billion in what will be the biggest M&A deal of 2020 so far. Federal Reserve Chair Jerome Powell testifies to Congress on Tuesday amid speculation of further policy action at its next meeting in mid-December. As a result, U.S. 10-year yields are ending the month almost exactly where they started at 0.84%, a solid performance given the exuberance in equities.

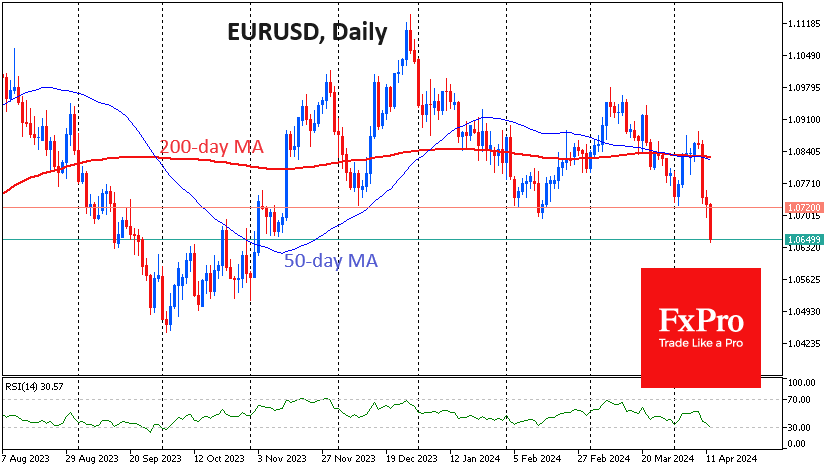

Against a basket of currencies, the dollar index was pinned at 91.704 after shedding shed 2.4% for the month to lows last seen in mid-2018. The euro has benefited from the relative outperformance of European stocks and climbed 2.7% for the month to reach $1.1973. A break of the September peak at $1.2011 would open the way to a 2018 top at $1.2555.

The dollar has had its worst month against emerging-market currencies in almost two years and even declined against the Japanese yen, a safe haven of its own. It has lost 0.7% in November to reach 103.89 yen, though it remains well above key support at 103.16.

Sterling stood at $1.3326, having climbed steadily this month to its highest since September, as investors wagered a Brexit deal would be brokered even as the deadline for talks came ever closer.

One major casualty of the rush to risk has been gold, which was near a five-month trough at $1,769 an ounce, having shed 5.6% in November.

Stocks set for best month ever, dollar and gold pay the price, Reuters, Nov 30