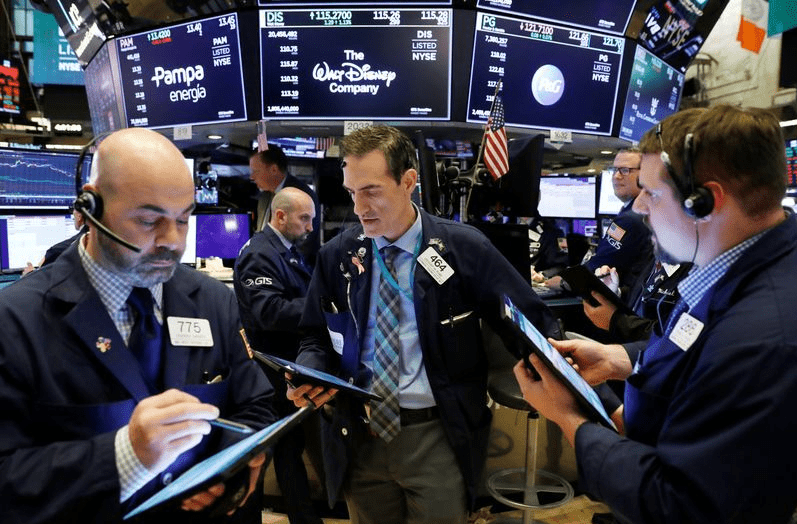

S&P 500 Near Record Sets Stage for ‘Critical’ U.S. Jobs Report

August 07, 2020 @ 13:35 +03:00

Today’s jobs report could be make-or-break data for U.S. equities. The S&P 500 is 1.1% below its closing high in February as investors head into the July nonfarm payrolls report at 8:30 a.m. New York time Friday. The biggest economy is expected to have added almost 1.5 million jobs in July, with the unemployment rate dropping to 10.6% from a prior 11.1% and average hourly earnings declining 0.5%, according to the median of estimates compiled by Bloomberg News.

Results of BMO’s pre-payrolls survey “suggest a degree of downside is already reflected” in Treasury yields, “which raises the bar for any weakness in Friday’s number to truly shock investors. This does not preclude a robust report from inspiring a sell-off, but we suspect that would only further cement the trading range.” “46% see a retest of 3,000 in the S&P 500 before reaching 3,600, while 54% anticipate an extension of the bullishness in equities to reach that threshold before any revisit to 3,000,” Lyngen said about the split in responses in the survey.

“With stocks enjoying a multi-day rally, and the dollar under a constant artillery barrage all week, the risks are that a disappointing number and or a massive downward revision to last month, sets of a potentially ugly short-term correction. That could see the U.S. dollar jump, stocks retreat and also knock gold off its record-highs perch. An aggressive fall by U.S. stocks would be a stern test for gold, as recent times suggest the two have a high correlation in such circumstances.”

Expectations for a strong jobs data “could be low considering how weak the ADP report was earlier this week. The ADP report is not always a great leading indicator for the employment report but we’ll see if there is a higher correlation this month. If the number surprises on the downside and the unemployment rate doesn’t dip below 11% then we could see a market pullback on the news.”

S&P 500 Near Record Sets Stage for ‘Critical’ U.S. Jobs Report, Bloomberg, Aug 7