Ships, trains, caves: Oil traders chase storage space in world awash with fuel

April 22, 2020 @ 13:22 +03:00

Oil traders are struggling to find enough ships, railcars, caverns and pipelines to store fuel as more conventional storage facilities fill up amid abundant supply and plummeting demand due to the coronavirus crisis. Dozens of oil tanker vessels have been booked in recent days to store at least 30 million barrels of jet fuel, gasoline and diesel at sea, acting as floating storage, as on-land tanks are full or already booked, according to traders and shipping data.

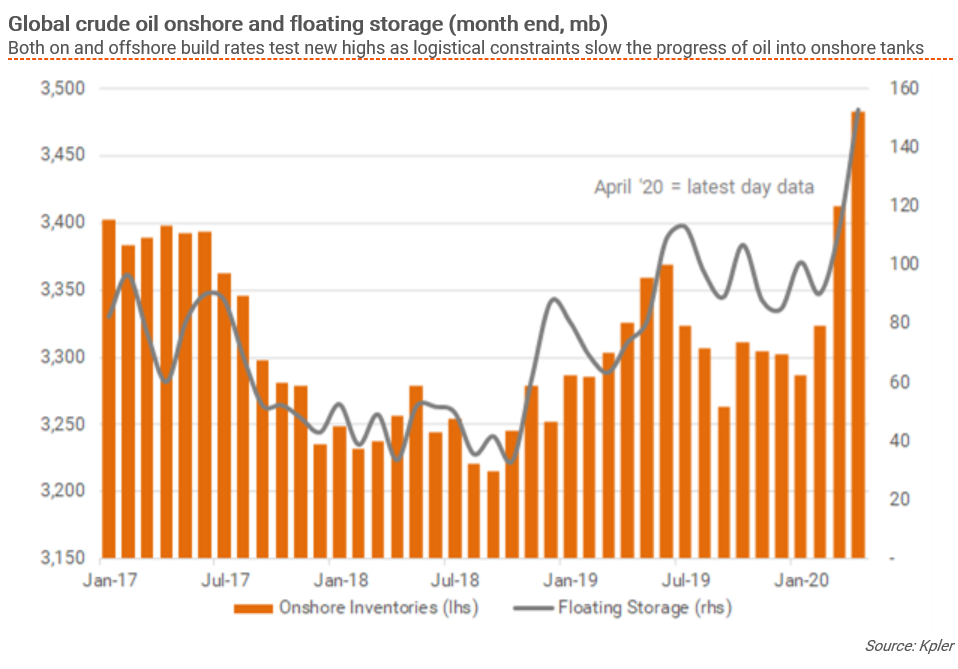

That adds to about 130 million barrels of crude already in floating storage, traders and shipping sources said. Demand for oil and its products has tumbled as much as 30% as governments around the world have told citizens to stay home to prevent the virus spreading – grounding planes and leaving cars parked up. But the world remains awash with oil supplies. OPEC, Russia and other major producers have forged a deal to curb production, but it will only reduce supply by about 10% and it does not kick in until May.

It is hard to gauge the world’s total oil storage capacity, but signs that the limit is being reached are increasingly obvious. Rising sea storage is one indicator, as it is more expensive than storing onshore and can be technically complex. Oil producers, refiners and traders are also turning to more unusual tactics, such as storing crude and fuel in railcars in northeastern United States or in unused pipelines.

In hubs with a little space left, such as Chicago, tank operators can charge a premium and longer leases. They have been demanding leases of 24-36 months rather than the more usual 12 months, according to two refined products brokers. With the market oversupplied, oil prices have plunged to their lowest levels in two decades. This week, U.S. Western Texas Intermediate made an unprecedented dive into negative territory, so sellers had to pay people to take it.

Despite the plummeting crude price, some refineries which are able to find space can still make money producing fuel. “Margins are OK because there is more flexibility in the products market relative to crude,” a senior official at a European refinery said. And nimble traders are creating new storage options. Tanker vessels carrying at least 1.5 million barrels of diesel have been diverted in recent days from their original European destinations to the New York region to anchor in storage, according to traders and shipping data. But many refineries are reducing output or, in some cases, shutting down as they no longer have any place to put oil to be processed or the products they make.

Ships, trains, caves: Oil traders chase storage space in world awash with fuel, Reuters, Apr 22