Next Step for Institutional DeFi? Institutional NFTs

March 09, 2021 @ 14:02 +03:00

The institutional appetite for decentralized finance (DeFi) is being extended to incorporate the frothy world of non-fungible tokens (NFTs). Announced Tuesday, custody and wallet technology firm Trustology is providing support for Ethereum-based NFTs, with a view to allowing institutional investors to use these tokens as collateral, for example, within the DeFi space.

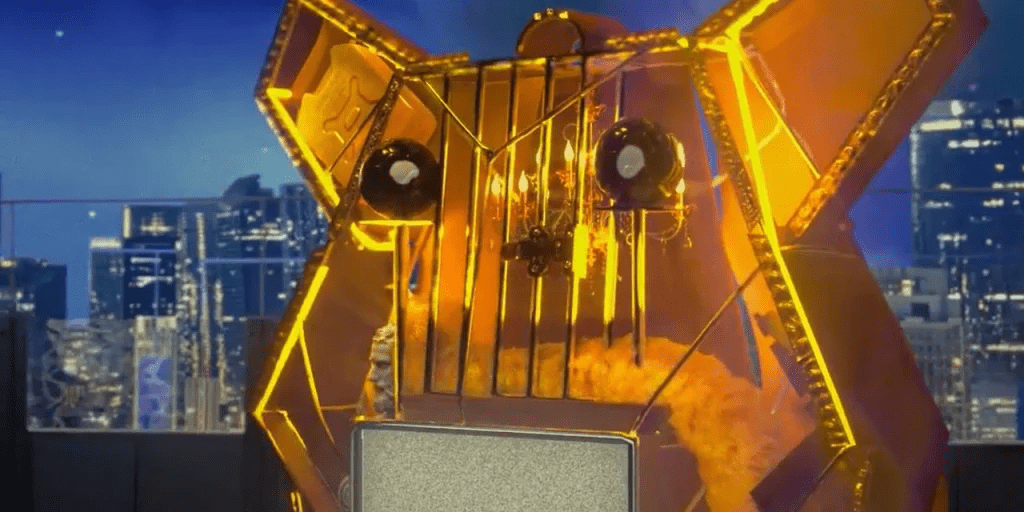

There’s currently an explosion happening in NFTs, which can be thought of as blockchain-based title deeds to a digital artifact. The trend is a carry-on from things like the original CrypoKitties phenomenon in 2017, with the technology (Ethereum’s ERC-721 token standard) later morphing its way deep into the world of digital art.

Today, the value being conferred on everything from art to music to seminal tweets is measured in hundreds of thousands or even millions of dollars. Meanwhile, institutional NFT is becoming a thing, with funds like Delphi Digital, Scalar Capital and Sfermion investing in digital collectibles.

Like DeFi, NFTs are normally associated with non-custodial wallets. But a collection of valuable NFT assets being managed on the behalf of a fund, for instance, would require a custody solution including rules to allow certain individuals to lend the asset or use it as collateral, said Batlin.

Next Step for Institutional DeFi? Institutional NFTs, CoinDesk, Mar 9