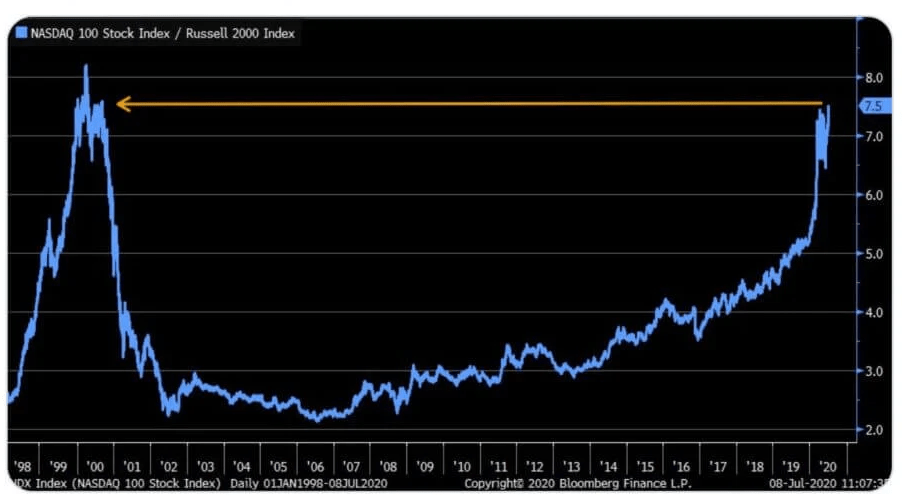

Nasdaq Hits Alarming Russell 2000 Ratio Unseen Since Dot-Com Bubble

July 09, 2020 @ 13:14 +03:00

As if the Nasdaq wasn’t looking bubbly enough, yet another blatant comparison with the dot-com bubble has emerged. Will this be enough to slow down the relentless bullishness in the U.S. tech sector, or will the bulls continue to run wild.

It’s been a terrible few months to be a Nasdaq bear on Wall Street. Although they got the collapse they’ve been calling for years, the massive rebound left many on the sidelines and valuations even more stretched.

Just how stretched? Well, the NASDAQ 100/Russell 2000 ratio is now at the highest level that it has been since 2001 when the chickens came home to roost and the bubble burst. Massive unemployment, surging virus cases and generally weak economic conditions have done nothing to slow the Nasdaq’s recovery down. While it looks irrational on the charts, like all big moves in the stock market, it is founded in some truths.

First, the $trillion giants like Amazon, Apple, Microsoft and Google are all in the tech sector. Faced with an economic disaster, investors have seemingly opted for the best balance sheets they can find.

While airlines and cruises struggle with debt and former global players like Hertz fumble with bankruptcy, Apple is still buying back shares and has $billions of free cash on its books.

Faced with the U.S. Federal Reserve printing a historic amount of USD, we have once again seen money flow into asset prices. Ample liquidity has fuelled risk-taking, and it is not just the ultra-caps that have gone up hugely.

Tesla stock has enjoyed a meteoric rise, and is now worth more than $1300 a share, making it the world’s most valuable car company. Is it that profitable? No. Do fans think it’s going to rule the world? A lot of them do, yes.

Nasdaq Hits Alarming Russell 2000 Ratio Unseen Since Dot-Com Bubble, CCN, Jul 9