Markets after Armageddon: Dead cat bounce or green shoots?

March 13, 2020 @ 14:24 +03:00

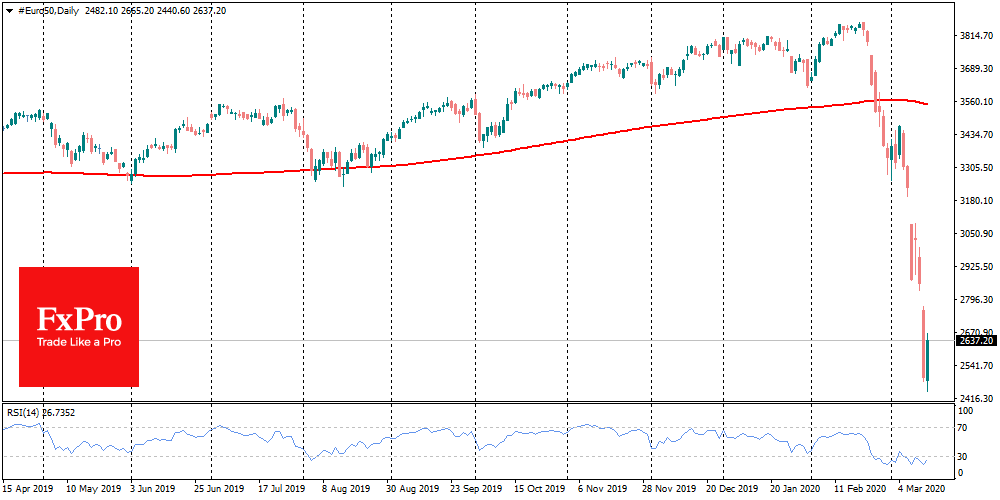

Markets on Thursday were experiencing one of the sharpest declines in their history. The fall of the American indices was approaching 10%, becoming the worst since 1987, European markets were losing even more as FTSE100 collapsed by 10.5% by the end of Thursday. From the start of trading on Wednesday to its lowest point on Friday morning, the EuroStoxx50 lost 15%, reversing towards growth only at the end of trading in Asia.

Futures on the Dow Jones, S&P500 added about 5% since the beginning of the day in response to unprecedented measures announced by the Fed. The American central bank announced a $500 billion liquidity injection and promised to add another $1 trillion. Central banks in Malaysia, Indonesia, Japan, Korea, and many others announced their support programs in addition to the measures taken earlier this week by the ECB and Bank of England.

Monetary measures are not helping much in the fight against viruses. They aimed to mitigate the negative impact on the economy caused by market panic and widespread sell-offs. The most frightening thing about yesterday’s decline was that all assets were falling.

Previously, the decline in stocks had fuelled the demand for gold and bonds, but on this sell-off, they were also in red. It is no exaggeration to say that yesterday was the day when cash was the king.

After the sharpest decline in its history the previous day, European markets are adding 1.5-3.0% at the opening of trading. Investors are now trying to figure out if these are the first green shoots in the markets after Armageddon or a dead cat bounce? As always in such cases, it will take a certain degree of luck to guess the right answer.

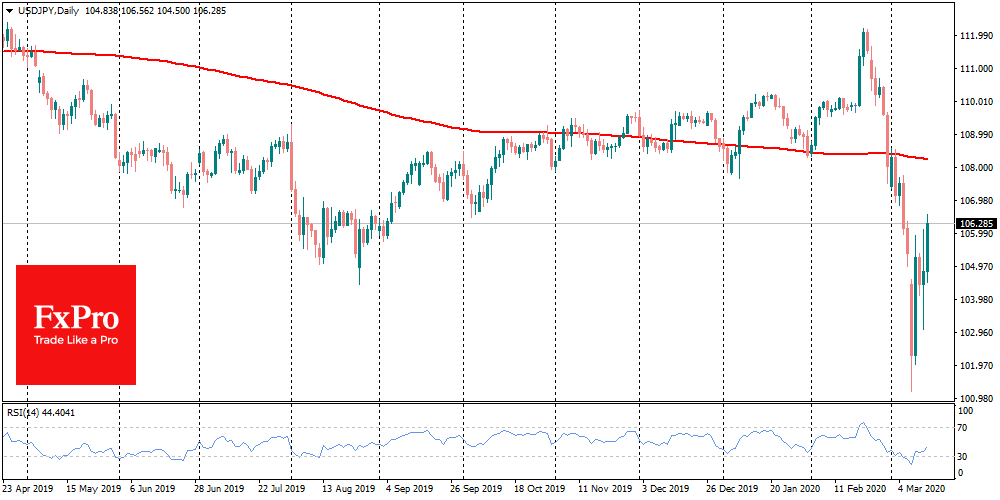

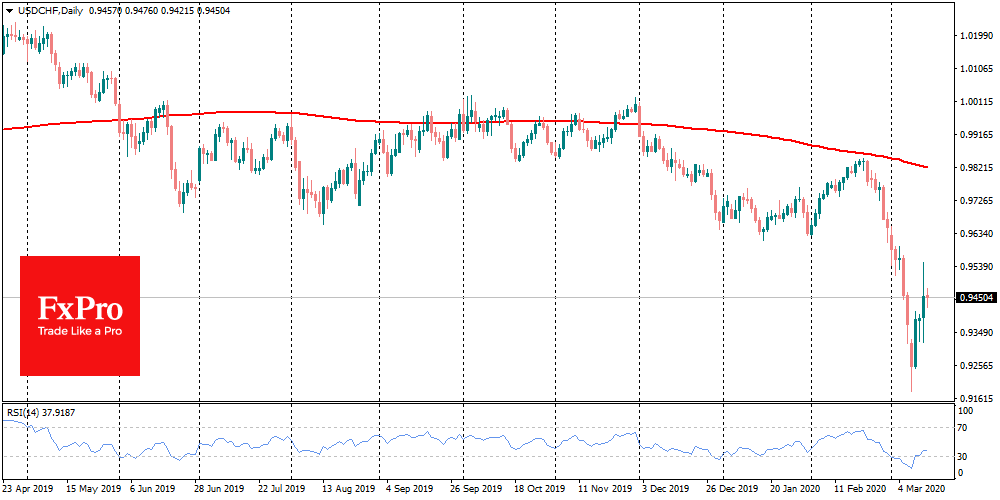

Some signs suggest cautious optimism. Gold has returned to growth, which is a signal that investors are now looking at gold as an insurance against inflation that central bank stimulus measures can reinforce. Safe-haven currencies – the yen, the franc – are retreating from previously achieved extremes. This may be a sign that there is enough liquidity in the markets, and now slowly the focus is shifting the impact on the economy and licking the wounds of investors after the grand market movements the day before.

The FxPro Analyst Team