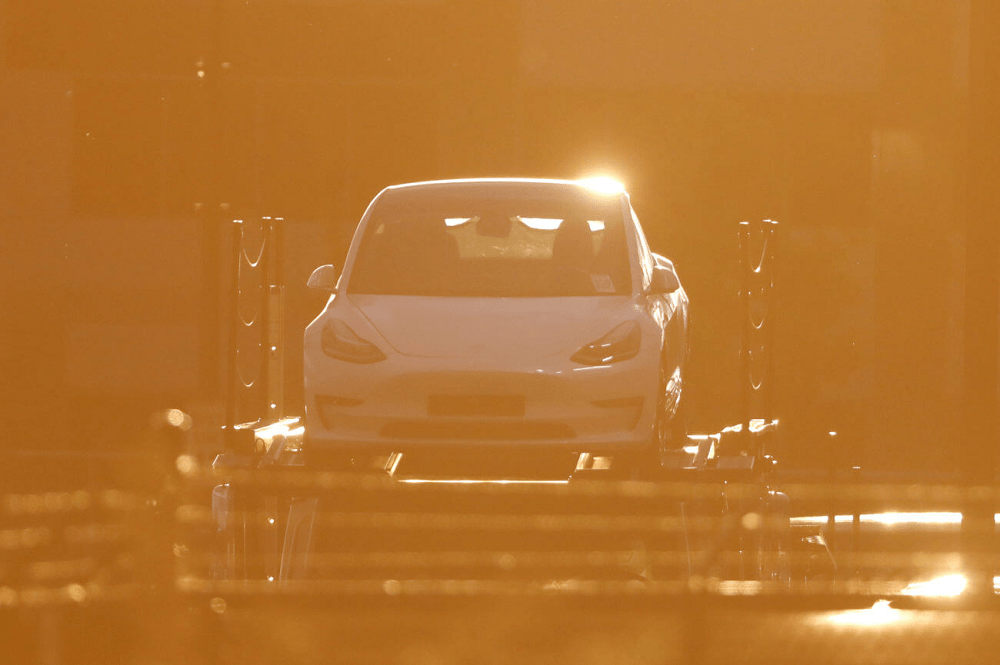

Long Tesla Stock? Electric Vehicle Sales on Course to Overtake Fossil Cars

May 22, 2020 @ 12:22 +03:00

Tesla’s stock is already bucking the coronavirus trend, but today, investors received more good news. Bloomberg published its annual electric vehicle outlook (EVO) report, finding that sales for fossil-fuel cars have peaked. Better yet, electric vehicles (EV) will account for most automobile sales from 2037.

EV sales will recover more quickly from the coronavirus downturn than sales for combustion vehicles. While Tesla’s future looks bright, it’s going to face increased competition in the EV market.

Things are getting increasingly tough for combustion vehicles (CVs). Not only are a growing number of nations planning to phase out CV sales and/or production in the coming years, but Bloomberg found that such sales peaked in 2017. Worse still, “they are in permanent decline.”

What’s revealing about Bloomberg’s figures is that they assume that phasing-out targets won’t be met. In other words, the decline in CV sales could be even more rapid. If nations do begin phasing out CVs, we could see a massive drop from around 2030.

These are all positive developments for Tesla’s stock, which is already having a spectacular 2020. Even with the coronavirus downturn, Tesla is up by nearly 300% from a year ago.

Nonetheless, Tesla isn’t the only car manufacturer in the world and could become a relatively small EV player in the future. That’s because much larger manufacturers are all ramping up their EV production.

For instance, GM announced in March that it would launch 20 new EV models by 2023 while raising its spend on EVs and autonomous vehicles to $20 billion by 2025.

Long Tesla Stock? Electric Vehicle Sales on Course to Overtake Fossil Cars, CCN, May 22