Hong Kong’s new tech index up nearly 2.9% on second day of trade

July 28, 2020 @ 10:28 +03:00

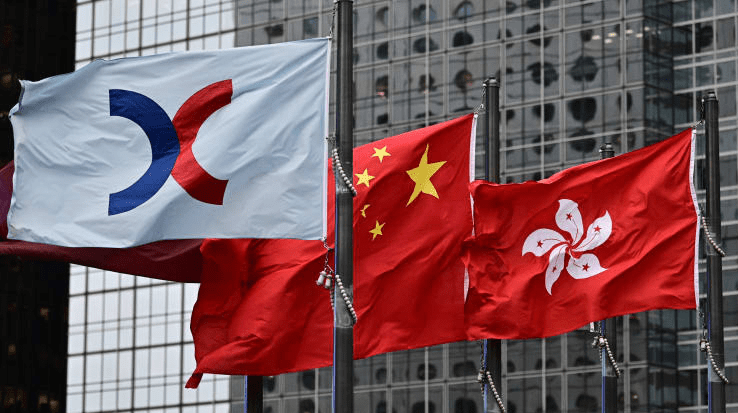

Hong Kong’s new tech index rose on its second day of trading as experts said its diverse list of constituents will be attractive for traders looking to invest across the sector. The Hang Seng Tech Index rose 2.64% as of 2:18 p.m. HK/SIN, beating the broader Hang Seng index which traded up 0.34%.

The tech index was launched on Monday and will track the 30 largest technology companies listed in Hong Kong that pass the screening criteria. Tech shares are some of the top traded stocks in Hong Kong. The new index trades at about 45 times earnings, versus the Hang Seng Composite Index’s price-to-earnings ratio of 12, according to data published by Hang Seng Indexes Company before the new index’s first day of trading.

The top five firms listed on the index are Alibaba, Tencent, Meituan Dianping, Xiaomi and Sunny Optical, which had a combined weight of more than 40% as of July 17. Others include Ali Health, JD.com, Lenovo, Ping An Good Doctor and ZTE.

Analysts at Citi said interest in the new index may draw some attention away from the tech-heavy Nasdaq in the U.S. and could lead to more turnover at the stock market operator, Hong Kong Exchanges and Clearing, with “more related index linked products” that could be issued.

The index’s constituents will be reviewed quarterly and a fast-entry rule could allow significant tech companies that go public in Hong Kong to be included if they meet certain requirements. That implies when fintech giant and Alibaba affiliate Ant Group goes public, it could potentially be added to the index.

Rising U.S.-China tensions have prompted some Chinese companies listed on Wall Street to return to Hong Kong. For example, the likes of Alibaba, JD.com and NetEase have carried out secondary listings there. More could follow if a U.S. bill that may force Chinese companies to delist from U.S. stock exchanges is passed.

Hong Kong’s new tech index up nearly 2.9% on second day of trade, CNBC, Jul 28