Gold Nears $1,900 as Veteran Mobius Says Keep Buying

July 24, 2020 @ 11:08 +03:00

Gold traded near $1,900 an ounce, edging closer to its all-time high set almost nine years ago, as concerns about global growth buoyed haven demand.

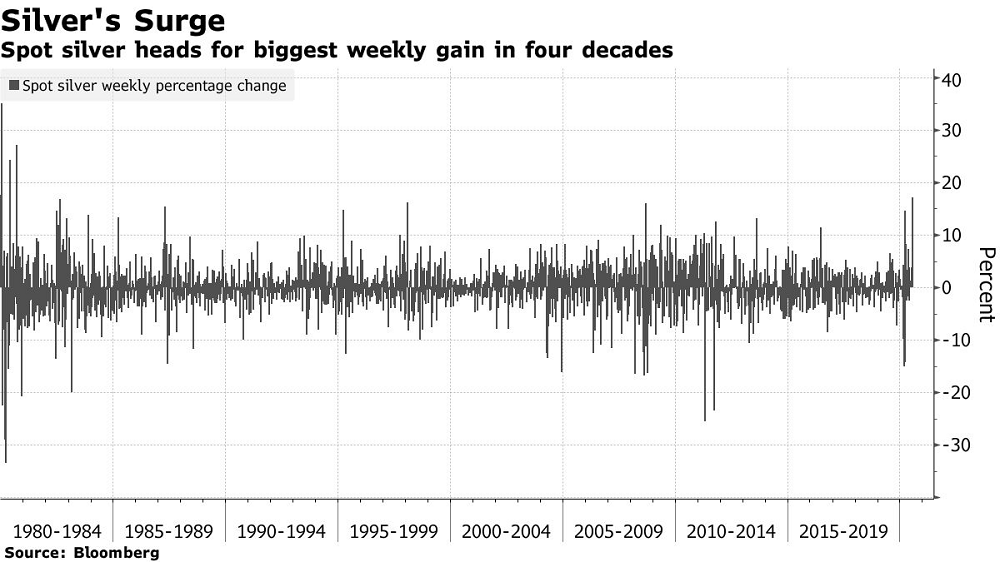

Increasing signs that the prolonged coronavirus pandemic is stalling an economic recovery and the recent surge in tensions between the U.S. and China are underpinning demand for the metal. Bullion is heading for a seventh weekly gain, the longest stretch since 2011, while silver is poised for its biggest weekly advance in about four decades.

Negative real rates, a weaker dollar, concerns over the economic cost of the health crisis and geopolitical uncertainties have put both precious metals on track for their biggest annual gain in a decade. UBS Group AG raised its near-term forecast for gold to reach $2,000 an ounce by the end of September, citing its qualities as a diversifier in a low-rate world.

“When interest rates are zero or near zero, then gold is an attractive medium to have because you don’t have to worry about not getting interest on your gold and you see the gold price will rise as uncertainty in the markets are rising,” Mark Mobius, co-founder at Mobius Capital Partners, said in a Bloomberg TV interview. “I would be buying now and continue to buy, because gold is really on a run, it’s doing well.”

Spot gold declined 0.2% to $1,884 an ounce at 1:40 p.m. in Singapore. Prices touched $1,898.34 on Thursday, nearing the record $1,921.17 hit in September 2011. Spot silver was steady at $22.6022 an ounce, and is poised for the biggest weekly advance since 1980.

Gold Nears $1,900 as Veteran Mobius Says Keep Buying, Bloomberg, Jul 24