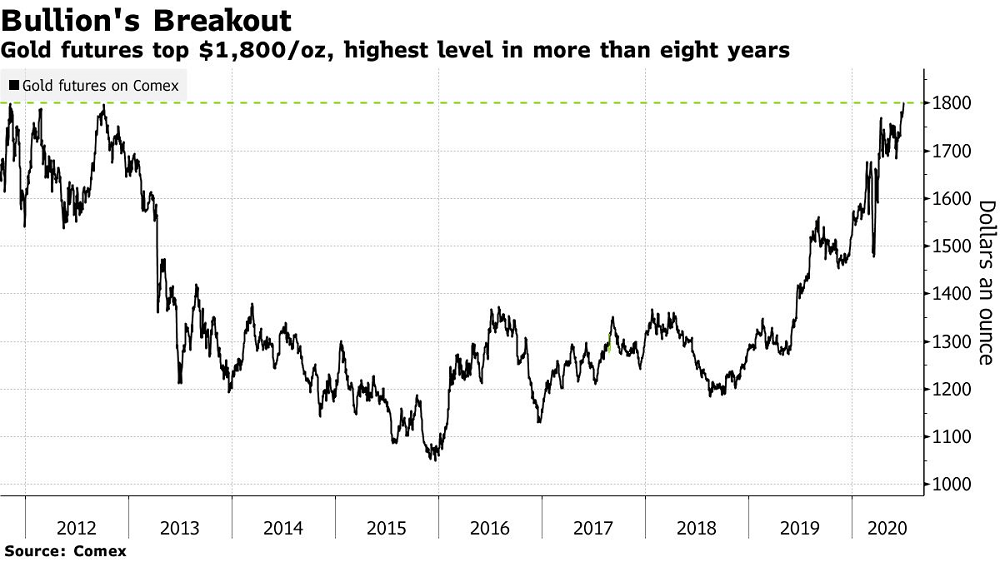

Gold Market Zeroes In on Curve Control After Futures Top $1,800

July 01, 2020 @ 14:10 +03:00

Fresh from futures cracking $1,800 an ounce, the global gold market wants to know what the Federal Reserve may do next to rescue the U.S. economy, with minutes due later Wednesday that are expected to shed light on the central bank’s willingness to embrace yield curve control.

Gold futures held near the highest in more than eight years, with a focus on the central bank release and warnings about the coronavirus pandemic. Pinning U.S. yields down — if adopted — may aid bullion’s allure. On the outbreak, Fed Chair Jerome Powell stressed on Tuesday that getting the virus under control was vital, while disease expert Anthony Fauci said new U.S. cases could spike.

Gold’s ascent in 2020 has been underpinned by aggressive central bank action to counter the pandemic’s economic fallout, with U.S. real interest rates already negative. The minutes of the Fed’s June 10 meeting may add detail on policy makers’ view on curve control, a strategy that involves using bond purchases to cap yields on certain maturities at a specific level.

Just over half of the economists surveyed by Bloomberg said they anticipate the Fed will eventually set target yields for certain maturities of Treasury securities, with most saying an announcement could come in September. Should curve control go global, it could spark a “buy everything” rally that ripples across credit, equities, gold and emerging markets.

Comex gold futures, which topped $1,800 an ounce on Tuesday for the first time since November 2011, were at $1,805.30 at 9:32 a.m. in London. Prices rose 13% in the three months to June 30 to cap seven quarters of gains, the best run since 2011. Spot gold was at $1,787.64 an ounce.

Among other main precious metals, spot silver rose 0.7% Wednesday after posting its best quarter since 2010. Platinum added 0.5%, while palladium edged lower.

Gold Market Zeroes In on Curve Control After Futures Top $1,800, Bloomberg, Jul 1